You can’t always be sending money wire transfer to people in your country or abroad by writing a check or using a credit card. A wire transfer can get your money where it needs to go safely, securely, and quickly, regardless of the circumstances.

What is the procedure for sending a wire transfer?

Sending a wire transfer involves, depending on what type of transfer you need:

- You are getting the information you need.

- You are choosing your preferred wire transfer option and submitting your application.

- Tracking your transfer to make sure it was received.

READ ALSO:- receiving money wire transfer.

What do I need to send a wire transfer?

Sending a wire transfer requires you to know:

- You need to send how much money.

- Name, address, and contact information for the person you are sending money to.

- Information about the recipient’s bank account, including routing and account numbers.

- The urgency with which your recipient needs the money.

- You can transfer money directly to a bank account or pick up cash at a money service branch.

- The wire transfer can be paid with cash or through your bank account.

Easily send money transfers by comparing providers

| Service | Transfer Time | Transaction Charges |

| MoneyGram | Within minutes | $3 |

| Western union | 4-5 Business Days | $0 |

| Wise | Within minutes | 4.14 USD |

| XE | Within minutes | $3 |

| InstaReM | Within an hour | $1 |

What are the options for wire transfers?

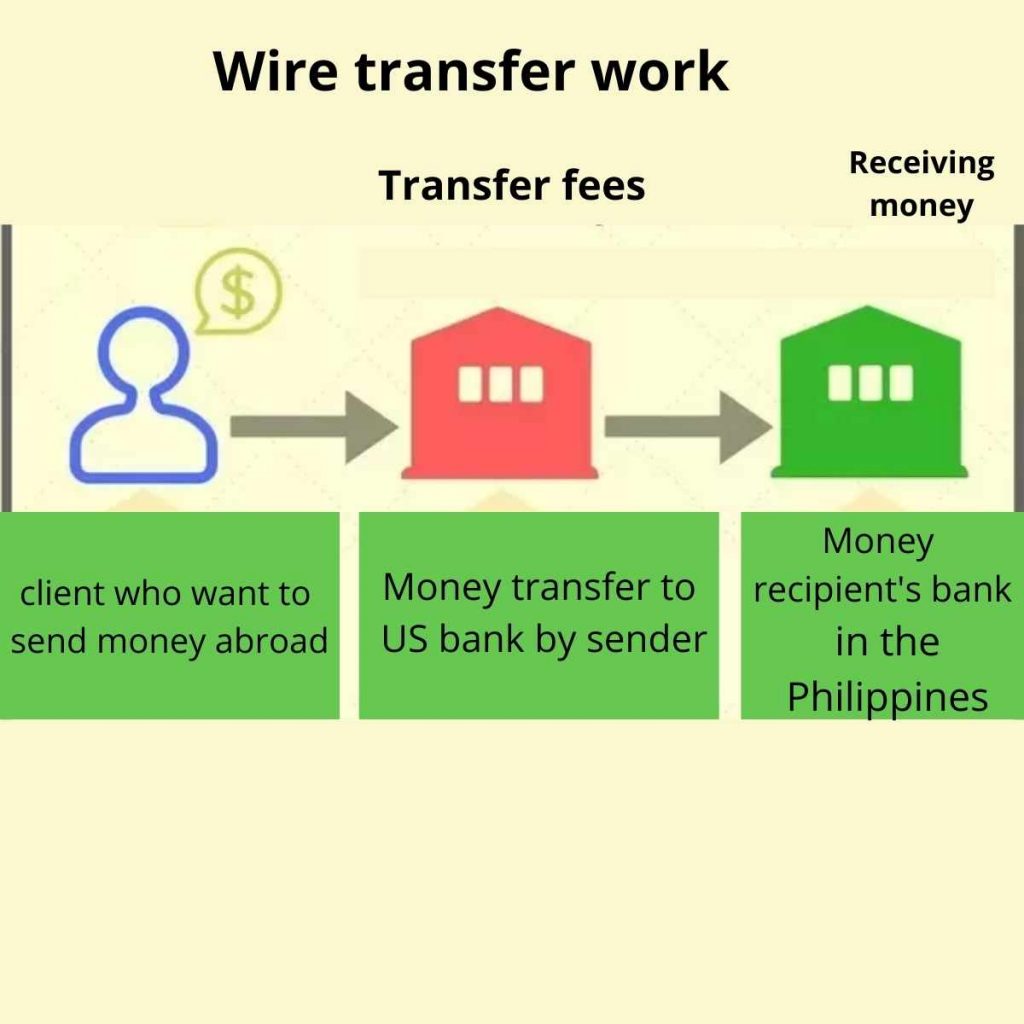

Wire transfers can be conducted bank-to-bank, in a money services office, or online.

Wire transfers from bank to bank

| A bank-to-bank wire transfer sends money directly from your bank account to another bank account, usually by filling out a form with the recipient’s account details and contact information. |

| Safe and familiar. Banks in the U.S. are much more secure against scams and thieves. Your information is also protected so that you can make multiple payments if necessary. |

| International transfers. (x)Exchange rates that are weak and high transfer fees. The cost and exchange rate for outgoing domestic wire transfers vary from bank to bank, but international wire transfers cost between $35 and $65 and cost between $14 and $40. |

| Wait time: 0-5 days on average. Wire transfers usually take a few days – but can take less time between banks. |

Wire transfer within the office

In-office wire transfer companies like Western Union offer quick transfers and are available worldwide.

You need to fill out a form with your information and your recipient’s information, including the address of the office where your recipient will pick up the money. If you’re sending money internationally, confirm the exchange rate and save your tracking number so that you’ll be notified when it’s arrived safely.

| Immediately. Perfect for a recipient who needs cash fast |

| (x) Wire options can vary. You may be required to use cash instead of a debit or credit card, depending on where you are sending money or which company you use. |

| Wait time: 0-5 days on average. Most transfers are completed in one to two days, but international transfers can take longer. |

Transfers online

Due to lower fees and ease of sending money abroad, online services like PayPal, OFX, and WorldRemit have become increasingly popular. In order to make a transfer, you will need to create an account and attach your bank account or credit card. After you save your financial information, future transfers will be easier.

| The cost is lower. Competitive exchange rates and lower fees |

| (x) The service varies. Depending on the company you use, you may be limited in the amount of money you can transfer and where you can send it. |

| The average wait time for transfers is a few minutes. |

What will happen next?

When you receive confirmation that your wire transfer has been sent successfully, use your tracking number to make sure the money reaches your recipient.

If there are any problems with the wire transfer, you should contact the money transfer service you used – whether it was a bank, an in-office service, or online. Many banks and services that offer international wire transfers have 24-hour customer service lines for questions or concerns.

If you’re sending money internationally frequently or occasionally, wire transfers are a reliable option – especially when it needs to arrive quickly. When you think about your money, that’s the peace of mind you deserve.

Conclusion

Money can be transferred electronically through wire transfers. Bank transfers are also known as wire transfers. Wire transfers have several advantages. They are quick and secure. They are carried out from one bank to another.

FAQs

When does a wire transfer take place?

Using a non-bank money transfer service, wire transfers can be completed within minutes. Most domestic bank wire transfers are completed within three business days. Transfers between accounts with the same financial institution are usually completed within 24 hours.

To send a wire transfer, what do you need?

To send a domestic bank wire, you must provide the recipient’s name, address, bank account number, and routing number (ABA).

What are the risks involved with wire transfers?

Fraudsters use wire transfers to steal millions of dollars from U.S. consumers every year. Their services are helpful in transmitting funds to friends, relatives, and others you know well. You can send money quickly with Western Union, Moneygram, and similar businesses.

What is Zelle? Is it a wire transfer?

A peer-to-peer money transfer service, Zelle allows individuals to send and receive money between connected bank accounts.

Receive a wire transfer? What are the risks?

Wire transfer operations’ risk assessments should identify various risks, including credit risk, operational risk, systemic risk, compliance risk, technology/security risk, reputation risk, sovereign risk, and fraud risk.