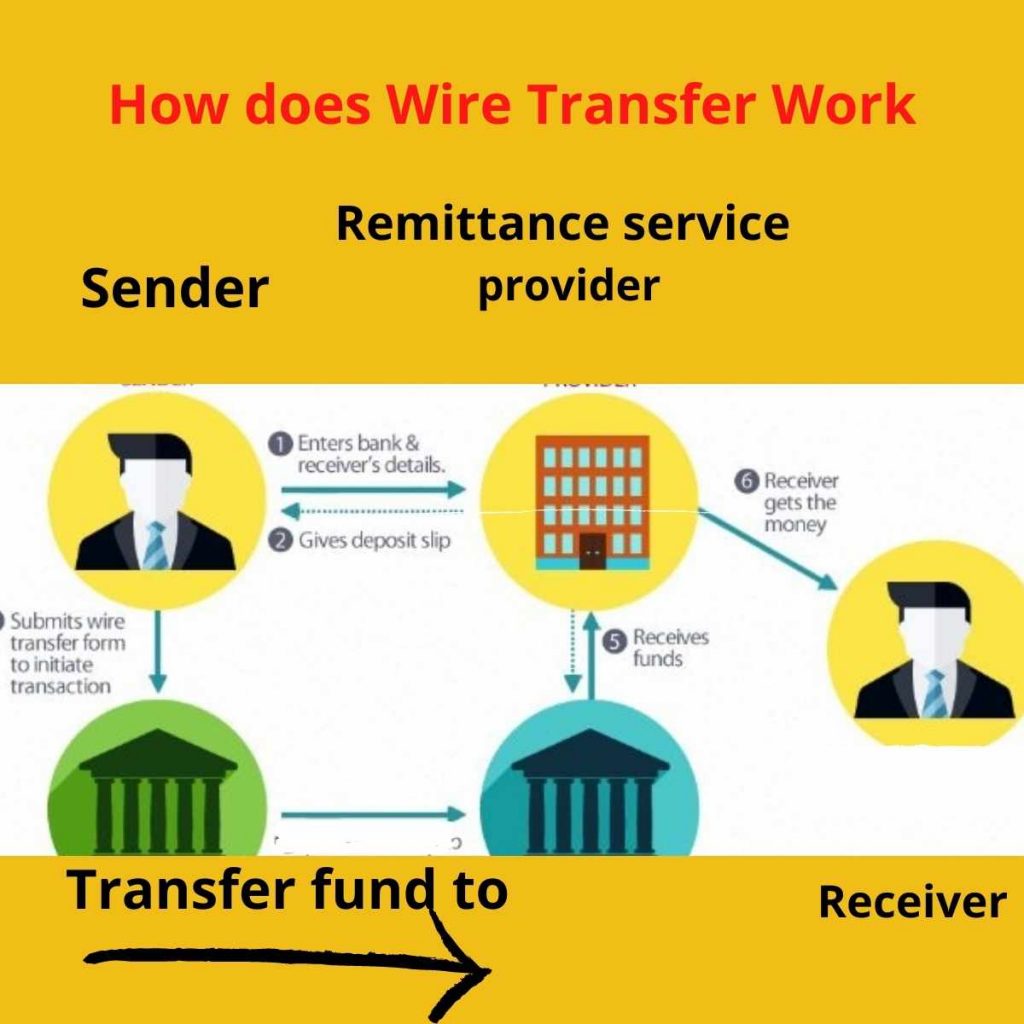

You can get receiving money wire transfer wire from banks, online transfer specialists, and money stores. The speed and cost of your transfer are determined by the method you use and how it’s delivered. Wire transfers are electronic methods of transferring money. They are also known as bank transfers. They have several advantages. They are fast and secure. A wire transfer takes place from one bank to another.

How do I receive a wire transfer?

In order to receive your money, you may be required to provide personal information, such as:

- Information about your name, address, and phone number.

- Information about your bank account, including routing and account numbers.

- If you are sending a wire internationally, you’ll need your bank’s SWIFT, BIC, or IBAN codes.

- Transfer of money and the reason behind it.

- PayPal and similar services require your email address for wire transfers.

- You need a branch or storefront location, as well as a tracking number in order to pick up cash in your office.

Read also:- sending money wire transfer.

Do you need a bank account to receive a wire transfer?

There is no. You need to deposit your funds directly into your bank account for bank-to-bank transactions. Online and storefront money specialists allow you to send money for cash pickup even if you don’t have a bank account.

Western Union allows cash pickups, while PayPal and similar sites provide intermediary accounts for deposits. You will need to provide the details of these accounts in order to receive a wire transfer.

Easily send money transfers by comparing providers

| Service | Transfer Time | Transaction Charges Fees (Pay by Bank Transfer) |

| MoneyGram | Within minutes | $3 |

| Western union | 4-5 Business Days | $0 |

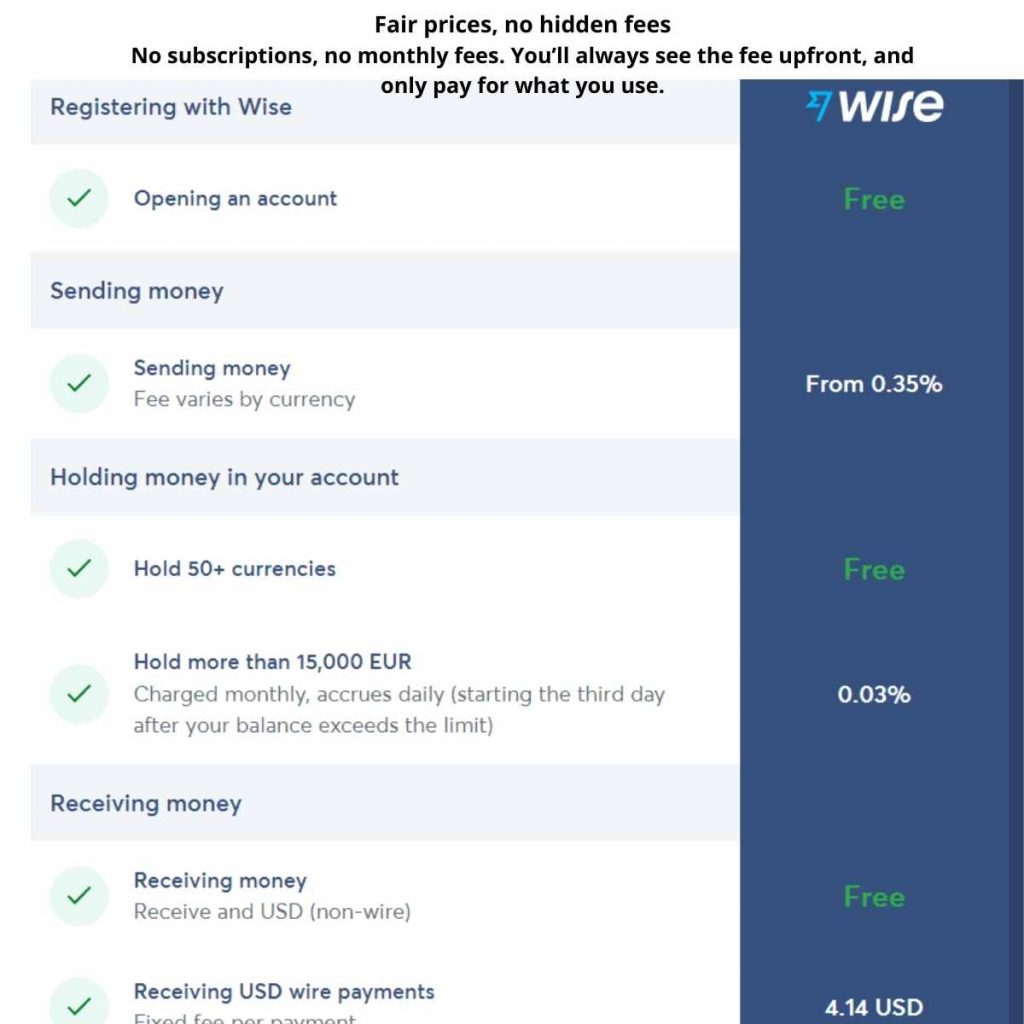

| Wise | Within minutes | 4.14 USD |

| XE | Within minutes | $3 |

| Remitly | Within minutes | From $0 |

| InstaReM | Within an hour | $1 |

What are the methods I can use for a wire transfer?

Getting a wire transfer depends on how it is sent – by the bank, online, or in person.

Wire transfers from bank to bank

After the transfer is complete, your account should reflect a transaction with the sender’s bank and the amount you expected.

Upon completion of the transfer, your account should reflect a transaction with the sender’s bank, and the amount of you’re account balance.

Wire transfers within the office

When using Western Union, MoneyGram, or a similar service, the sender typically receives a tracking or money transfer control number (MTCN).

You can use this number to monitor the progress of your wire transfer. When you pick up cash at a storefront, you will probably need this number to complete a form and receive your money.

Transfers online

When your sender wires your money through an online service, you’ll receive an email when the money has been credited to your account. Ensure you receive your money by opening your account.

What is the average time it takes to receive a wire transfer?

Depending on how your sender chooses to deliver the wire transfer, you may have to wait.

Transfers between bank accounts can take one to three days, with delays during weekends or holidays.

In-office wire transfers and online payment systems like PayPal facilitate money transfers or cash pickup in minutes.

Which is the best way to track a wire transfer?

Money transfer services and online specialists usually offer end-to-end tracking so you can monitor the progress of your payments.

Wire transfers in-office are typically notified by email when your money is ready to be picked up or withdrawn. A transaction number provided by the sender can often be used to track the transfer.

Email notifications are sent to both parties when the money is available for online transfers in the recipient’s account.

In most cases, bank-to-bank wire transfers can only be tracked via the sender’s online banking account. Make sure the funds have already been credited to your account from time to time.

Are there any potential drawbacks to using a bank wire transfer?

When you need a wire transfer, you have options. Choose between online specialist transfers and in-office transfers – you don’t have to stick with just one bank. You may want to compare your bank with online specialists because of the following reasons:

- The speed. For a typical wire transfer, banks have layers of bureaucracy and networks, which can take up to five days.

- Delivery is limited. Wire transfers are usually bank-to-bank. Some online specialists offer intermediary accounts from a bank if you do not have an account.

- Amount. Transfer fees can range from $20 to $60, sometimes on both ends. You’ll often see a high markup on the exchange rate if you receive money internationally.

- Transfer amounts are limited. Domestic and international accounts have different maximum transfer amounts.

- The details. Online specialists offer a more intuitive experience than banks when it comes to ID, forms, and in-store requirements.

CONCLUSION

Money can be transferred securely, quickly, and dependable with wire transfers from point A to point B. Money transfer specialists – both in-store and online – typically offer lower fees, faster transactions, and tracking for peace of mind compared to bank-to-bank wire transfers.

FAQs

How do I receive money from a wire transfer?

The sender must know the following in order to send funds to you (the recipient):

1. The full name on your account.

2. Your full account number.

3. For domestic wire transfers, your routing number.

4. To make international wire transfers, they need to use a Swift Code instead of the routing number.

5. The address for incoming wire transfers is

What is the address to receive wire transfers?

To receive money by wire, you’ll need to provide your bank account information to the person or business sending money. Ask your bank for incoming wire instructions to be sure you use the correct numbers.

After a wire transfer, how long does it take to receive money?

A wire transfer usually shows up in your bank account within 24 hours. Nevertheless, factors such as the bank’s policies and the time when the sender initiates the transfer can impact the deposit time.

How do I receive a wire transfer TD?

What are the steps to receiving a wire transfer?

1. Provide your name (as the account holder) and full address.

2. Include your account number.

3. Include your branch transit number and full branch address.

4. TD’s institution number is 004.

5. TD’s Swift Code (international): TDOMCATTTOR (applicable to all accounts and branches)