Certain personality traits influence money management. What is your level of anxiety and compulsiveness? Are you practical and grounded? How do you approach saving and spending money?

Katherine Gurney, founder and CEO of Financial Psychology Corporation and author of Your Money Personality: What It Is and How You Can Profit from It, has researched people’s financial traits for years.

We often act when it comes to our money,” she said. “Some of the traits are assets, and we would like to strengthen those traits. But they can become liabilities if not used properly.”

You can master your finances if you possess these 18 personality traits. Let’s find out what you already have and what you need to work on

What is your approach to the best apps for saving money and spending? Research into people’s financial traits has been conducted for years by Kathleen Gurney, CEO of Financial Psychology Corporation and author of Your Money Personality: What It Is and How You Can Benefit From It.

According to her, people tend to behave in ways that are unconsciously motivated by money. So our goal is to reinforce certain characteristics that are assets. They become liabilities if they’re not used properly.”

You can master your finances by using these personality traits. But, first, learn about the skills you already have and the ones you should learn.

Wealthy People Possess These Personality Traits

1. Thinking independently

Millionaires have different views. Money is not the only thing on the table. Millionaires spend their time and energy creating their path instead of conforming to the norm.

Because thoughts affect actions, people who wish to be wealthy should think to achieve their goals. Independent thinking is not about going against what everyone else does; it is about following what is important to you. Hence, we must forge our path here. Rather than trying to chase money, let your success drive you to financial rewards.

As an example, Forbes estimates David Geffen’s net worth in 2021 will be $9.9 billion. Record executive and film producer Geffen dropped out of college but made millions by starting record agencies, including DreamWorks Animation SKG Inc. He signed some of music’s best-known artists during the 1970s and 1980s. His tireless work ethic and personal belief in artists’ potential allowed him to amass a large fortune, despite not following what most people assume is the usual path to success.

2. The vision

Millionaires have a positive attitude and are creative visionaries. Rich people tend to have big dreams, and they believe they will come true. In this respect, wealth seekers should not be afraid to venture into unexplored territory.

In 2021, Bill Gates had a net worth of $124 billion, according to Forbes. Bringing personal computers to the masses, Bill Gates was the co-founder of Microsoft Inc. (NYSE: MSFT). In 1975, Gates began designing personal computers. In 1985, he created Microsoft Windows, a popular operating system. Gates knew how to profit from the new era of home computers as soon as consumers began to purchase them.

Among Bill & Melinda Gates Foundation’s accomplishments is that it is the world’s largest private foundation for charitable purposes. Gates donated $15 billion in Microsoft stock to the foundation. In addition, Gates has become an outspoken and respected speaker on climate change.

3. Skills

The Think and Grow Rich: A Black Choice (1992) book was written by Dennis Kimbro and Napoleon Hill after conducting interviews with successful people to see their traits. Success comes from focusing on one’s area of excellence. In addition to partnering with others, millionaires usually hire people who have weaker skills. Ask your friends and family what you are good at if you don’t know. You can refine your strong skills with training and mentorship.

4. Having a passion

- Buffett, the billionaire investor, says, “Money is a by-product of learning to like what I do very much.” For example, having a positive attitude toward work ensures that you will work hard every day. Often, people who work with money, such as bankers, enjoy negotiating new deals and persuading others.

- It may take time to become a millionaire. Additionally, many of them fail in their endeavors. Paul Marinkovic shows that Warren Buffett, former Microsoft CEO Steve Ballmer, and Rupert Murdoch of Fox made huge errors before achieving success.

- To succeed in life, stop doing things you don’t enjoy and start doing what you love.

- You have to try a few things before you find the one you love.

5. Investment

Millionaires sacrifice time and money to accomplish their goals. For the opportunity to achieve something more significant in the future, they are willing to take a risk now. What can achieve a great financial reward through investment in securities or starting a zero investment business. Start investing now.

Whether it’s saving for retirement, paying down debt, or boosting your emergency fund,h your boss to determine what steps you need to take to advance in your current role, you may also consider picking up a side hustle or trying a passive income idea.

READ ALSO: ground floor investing

READ ALSO: real estate investing

6. Social skills

- Every day, billionaires present their ideas and convince others to adopt them. A good salesman ignores any criticisms or naysayers. The answer to their problem is no. Social skills are also important for millionaires. When author T. According to the author of Secrets of the Millionaire Mind (2005), Harvey Eker analyzed a survey of 753 millionaires to understand the importance of social skills over IQ.

- Communicating effectively is the key to selling your idea. Millionaires, contrary to the traditional view of salesmen, attribute their success to honesty. A millionaire is someone who is honest in the business world and who has excellent social skills.

7. The control of

- Responsible financial decision-makers tend to be more confident about their finances. For example, the Journal of Economic Psychology published a study showing that people who manage their money actively tend to be significantly wealthier.

- Gurney advised people to start tracking their spending or setting up automatic payments for their bills as one way of taking control of their finances. Once you’ve accomplished a task, move on to the next one. By taking more control over your finances, you will be able to learn more about them.

8. Contentment

- Money anxiety is not uncommon. Nevertheless, being content and calm can contribute to financial success.

- According to an Allianz Life insurance company study of financial personalities, people that felt overwhelmed by financial concerns were more likely to be resilient, savvy, and distracted. who found overwhelmed personalities to be in a “survival mode.” By planning for the future, Gurney says one can reduce their anxiety.it is also helpful to seek advice from financial experts and read books by experts.

9. A thoughtful attitude

- Gurney said that financial decisions are more likely to be considered part of a bigger of effective people. As a result, they move forward knowing how to reach their goals rather than getting stuck on one bad step.

- “There are too many holes in a (golf) game to judge by one hole,” Gurney said. “Rather than judging your progress based on nine or 18 holes, you should evaluate your performance as a whole.”

- Impatience can also lead to bad money decisions like overspending. Develop willpower if you recognize this scenario. you shouldn’t spend money when you’re emotional. Instead, think about your financial future and commit to your goals.

10. Rationality

- Keeping emotions out of financial decisions can be achieved by being grounded and rational.

- Emotional people, on the other hand, tend to react rather than reflect. Poor outcomes can be the result of this.

- Investing is an especially risky endeavor that requires level-headedness, so if you find yourself on an emotionally exhausting stock market ride.

11. Taker Of Calculated Risks

You could lose your financial stability if you take on too much risk. On the other hand, missing out on opportunities can result from taking on too little risk. You can achieve financial security by taking calculated risks and finding a happy medium.

In making financial decisions, Gurney said, a calculated risk-taker calculates the probability of loss and gain.

12. The Power Of Trust

When a person doesn’t trust himself to make the right decision, Gurney says he doesn’t trust others either. People can suffer from this because they won’t trust anyone to assist them with money problems, and they’ll be skeptical of anyone’s advice.

You may be able to judge others more accurately if you trust yourself. Then, if you need a financial advisor, know that you can make the right decision, Gurney said.

13. A Sense Of Empowerment

- A confident person can take calculated risks, Gurney said. On the other hand, anyone who doesn’t feel empowered will shy away from taking risks because they’re afraid of failing.

- The sooner you feel empowered, the less likely you are to be a victim, Gurney said. In addition, the money-saving tactics you use, such as leveraging your credit, can help you save more when you’re empowered.

- Rationality Keeping emotions out of financial decisions can be achieved by being grounded and rational.On the other hand, emotional people tend to react rather than reflect. Poor outcomes can be the result of this.

- Investing is an especially risky endeavor that requires level-headedness, so if you find yourself on an emotionally exhausting stock market ride.

14. Taker Of Calculated Risks

You could lose your financial stability if you take on too much risk. On the other hand, missing out on opportunities can result from taking on too little risk. You can achieve financial security by taking calculated risks and finding a happy medium.

Gurney said that a calculated risk-taker calculates the probability of loss and gain in making financial decisions.

15. The Power Of Trust

When a person doesn’t trust himself to make the right decision, Gurney says he doesn’t trust others either. People can suffer from this because they won’t trust anyone to assist them with money problems, and they’ll be skeptical of anyone’s advice.

You may be able to judge others more accurately if you trust yourself. Then, if you need a financial advisor, know that you can make the right decision, Gurney said.

16. Self-Determination

Motivation and self-determination enable you to take charge of your finances. Gurney explains that instead of focusing on what they can’t control, they focus on what they can. As a result, they believe they can succeed no matter how many mistakes they make.

17. Optimism

It isn’t money that makes optimistic people happy, Gurney said. The thing that brings contentment is not the amount of money we have but how we spend it.

This study found that people who rely on material possessions to bring them happiness manage their money poorly and take on more debt, whereas those who rely on money for happiness are happier.

18. Willpower

When others around them spend extravagantly, people with willpower can resist the urge to spend unnecessarily.

Those who lack willpower should consider shopping with a list to avoid temptation. Gurney said they should have contributions to their retirement account taken right out of their paycheck so they don’t have a chance to spend it.

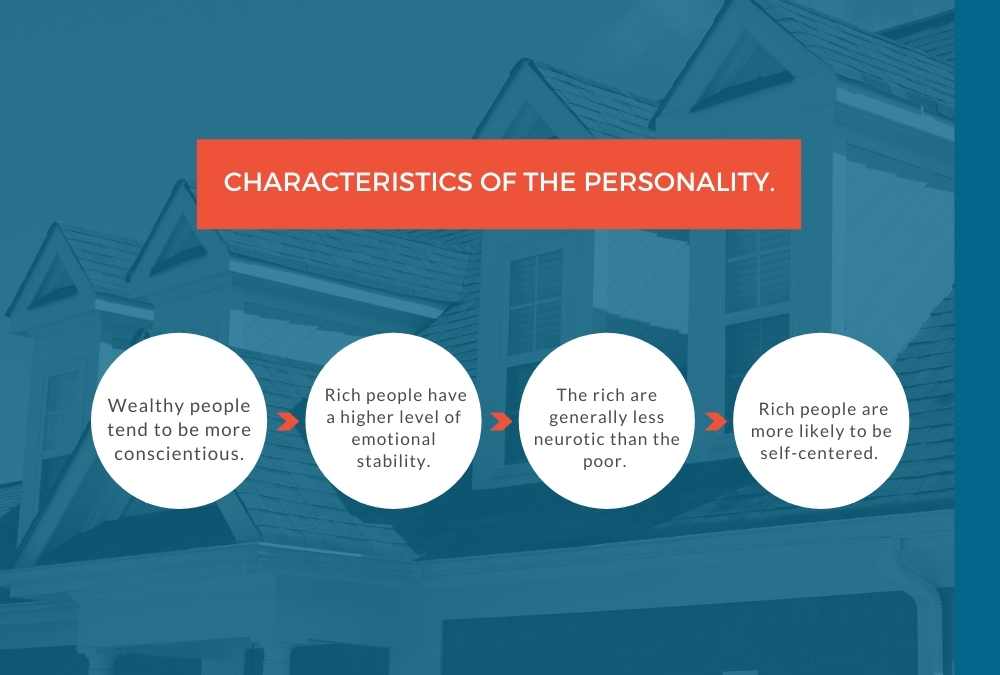

Especially in terms of characteristics of the personality.

A wealthy person is often extroverted. It’s not a surprise since nobody achieves anything significant on their own; engaging with others takes relationship building, motivation and inspiration, and the capacity to sincerely connect.

Wealthy people tend to be more conscientious. As well, no surprise there. Ensure that you are doing what you have to do, not what you want. It turns out that people who love and marry make more money, earn more promotions, and feel happier at work. (As Jim Rohn said.) we tend to become the average of the people with whom we spend the most time.

Generally speaking, rich people have a higher level of emotional stability.

Decisions based on emotion? Slowing down progress towards long-term goals certainly is not a good plan.

The rich are generally less neurotic than the poor.

You become less likely to succeed when you are easily fretted over, anxious, moody, or fearful. Psychologists call this “negative arousal”- it’s much harder to be successful.

Rich people are more likely to be self-centered.

It may sound like a negative aspect, but Adam Grant points out that humble narcissists have extremely high expectations for their success while also acknowledging that great accomplishments are almost always the result of collective efforts. This combination is key: Believing in your abilities helps you get started; knowing that other people are necessary to ensure your success helps you finish.

Therefore, personal qualities are important. Generally speaking, a willingness to work with others, keep working, keep doing the right things, not let short-term success or failure get in your way, and feel as if you are in control through your hard work and persistence. Individuals who possess those characteristics are important.

Still, changing your personality isn’t necessary.

Suppose you don’t fit any of the above descriptions? (Don’t worry: Some of this sounds just like me; others do not.)A person’s personality cannot be changed overnight, especially not completely.

You can, however, change a few things about yourself.

Don’t be afraid to adopt some “extrovert” characteristics. The wealthy are often extroverted, for instance. Introverted people do not have to change their personalities. Engage in active collaboration with others. Take charge of a task or project with another person. Even better, go with a more outgoing person. (Think Jobs.) it is the Microsoft of today.

If you are concerned about potential loss, you tend to make emotional decisions. Researchers have shown that losses have twice as much psychological power as gains: this is why many believe a bird in the hand is worth two in the bush. Read Daniel Kahneman’s Thinking, Fast and Slow for more information.

Conclusion:

Many ways are available to build wealth, but saving is the easiest and most common option. Don’t make any major purchases without first consulting a financial planner or reviewing your budget because buying on impulse can be costly in terms of money spent and time. Investing in retirement is important, whether you’re worried about having enough income in retirement or just thinking about how you can earn how much income will be needed and creating.

FAQs

How would you describe a finance professional?

An organization’s financial officers are responsible for overseeing its financial transactions. CFOs are also known as chief financial officers, and they are responsible for developing budgets, monitoring transactions, and preparing financial reports. This position requires solid analytical and accounting skills.

Do I have any strong personality traits?

How do I identify them?

Tenacious.

Confident.

Optimistic.

Self-aware.

Adaptable.

Which is the best way to describe someone in finance?

What are the key traits of an excellent investment banker?

Your skills should include:

strong numerical and analytical abilities.

Excellent teamwork and leadership skills.

communication and interpersonal skills