Are you located in the USA. and looking for a way to fund your family and friends in India without paying taxes? tax-free money transfer USA to India very easy way It is common for anyone to contact a leading bank based in the USA. directly to conduct the transaction; however, after reading this post, you are not required to follow the same strategy and can use a completely different one.

When it comes to exchanging rates and fees involved in it, the ways we recommend in this article will provide you with a better deal, which will ensure that your loved ones receive whatever you send them without any significant changes. In the same way, you can open a Zolve bank account and send money to India without any transaction fees.

Exchange U.S. Dollar (USD) and Indian Rupee (INR) remittance rates to send money overseas to loved ones. In one place, you can compare money transfer providers from the United States to India. Review remittance providers and learn about deals, promotions, and discounts. Depending on the provider, you can send money online or send cash.

READ ALSO:- InstaReM Review

Which is the best method for sending money to India from the United States?

There are so many options available when sending money from the U.S.A. to India. Additionally, the United States Dollar to Indian Rupee exchange rate fluctuates constantly. You can compare money transfer companies on Remitfinder to find the best exchange rate among this volatility and the best deals and promotions available.

You can easily compare many providers from one place to see which is the best option for your next transfer. Select the U.S.A. to India as your country combination and click search. By comparing many money transfer companies, we can provide you with the best exchange rate for sending money to India from the U.S.A.

On our site, our partners offer a variety of promotions and discounts to help you maximize your return on investment. Please take advantage of our United States Dollar to Indian Rupee remittance deals.

We compared 10 money transfer companies to find you the best remittance rates to send money from the United States to India.

You can use the table below to compare which option is best to use to transfer money from the U.S.A. to India. Review the list and compare different attributes, including the fees charged and the time it takes to complete the transaction.

| Service | Transfer Time | Transaction Charges |

| MoneyGram | Within minutes | $3 |

| Western union | 4-5 Business Days | $0 |

| Wise | Within minutes | $5 |

| Transfast | Within 24-hours | $4 |

| Western Union | Up to five days pending KYC validation | $5 fixed fee per transfer |

| O.F.X. | Most major currency transfers may arrive within 1-2 days. With most exotic currencies, this process may take anywhere from 3-5 days. | OFX doesn’t charge transfer fees |

| Revoult | Transfers reach you within 3 working days. | This fee is 2.5% for Standard and Plus users (and 1.5% for Premium and Metal users) |

| Ria Money | using a credit or debit card money transfer in 15 minutes. But if you are using a bank payment method, the processing time for the transfer can take up to 4 banking days depending on your bank. | There aren’t any fees or charges to receive a money transfer. All charges are paid by the sender. |

| WorldRemit | Usually on the same day for personal accounts. For business accounts, it will take 1-2 working days | Your first transfer is FREE |

| InstaReM | 2 business days to process a transaction | Transaction fees between 0.25% and 1% and no hidden charges. |

Which are the Best Apps for Money transfer USA to India?

I have divided the apps based on these three criteria:

1. Lowest cost,

2. Most Rapid,

3. Winner of all categories,

| Lowest cost | Western Union |

| Money can be transferred from the U.S.A. to India for free, making it the cheapest method. There is nothing cheaper than free. The huge market credibility makes your money transfer cheap yet secure. |

| Most rapid | Xoom MoneyGram |

| MoneyGram, like Xoom, is known for its speed. MoneyGram performs the same job in minutes, whereas other money transfer options take hours. Money transfers cost $20 for card-based transfers and $5 for account transfers. |

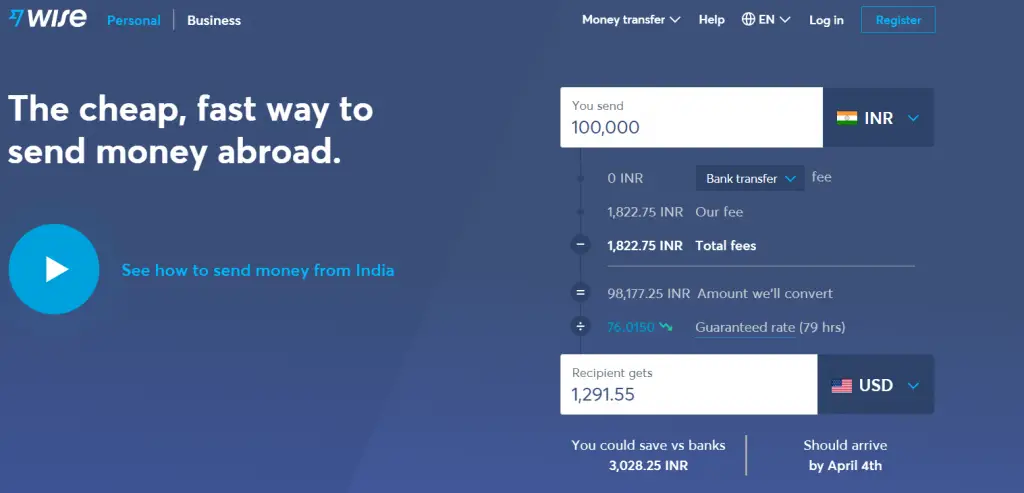

| Winner of all categories | Wise |

| 1. Overall, Wise (formerly called TransferWise) won all the metrics. However, the app has 4.5 out of 5 ratings, which indicates its credibility. 2. The web application is easy to use, and users can register with their Gmail or Facebook accounts. However, the interface is so clean that the transfer process looks like a walk in the park. 3. In the calculator, you can immediately calculate the fees involved in the transaction. To transfer or receive money, you will need a bank account, and you can send up to $1M, which most states support. 4. Though Wise charges a low transfer fee, it is not the cheapest method of sending money from the U.S 5. The fee for money transfers is $2.70 up to $300, and there is a 0.9 percent fee for amounts over $300. |

What is the process of transferring money from the USA to India?

This section will explain how easy it is to transfer your money from the U.S.A. to India.

- Comparing the available options – We have provided a table that can be used to compare the fees and turnaround times associated with money transfers. Choose an option that suits your needs.

- Create an account – You must provide your name, address, proof of I.D.I.D., contact number, and the payment mode when you register an account with the website from where you want to transfer funds.

- Details of the receiver – Please provide the recipient’s name, contact information, etc. Money must be transferred directly to the account of the recipient if you wish to do so.

- Enter the amount to transfer – Then you can enter the amount you want to transfer and proceed with the transaction after confirming everything, such as the duration, transaction fee, and exchange rate.

A list of ways to send and receive money

- Deposit in a bank: A bank transfer is considered the safest way of transferring money from the U.S.A. to India since you deposit your money in a bank in the U.S.A., and you can withdraw it from any bank in India; however, there is a high transaction fee and a lower exchange rate involved with this method.

- Transferring money online: Money transfer options online are considered easy and safe. Companies like Dunbridge Financial and O.F.X. facilitate money transfers to India, making them more convenient than direct bank transfers.

- Here are the transfer agents in the U.S.: There are many agents in the U.S.A. that can help you transfer money safely to India, and your recipient in the U.S.U.S. can easily receive it.

- Using a check or money order: You can also consider checks and money orders if you are not in a hurry to transfer your money.

What documents are needed to transfer money from the U.S.A. to India?

- Photo ID– The most commonly used photo I.D.sI.D.s are driving licenses, passports, and government I.D.sI.D.s.

- Payment Methods– Generally, cash, debit, and a credit card are accepted by your service provider.

- Details of the recipient –To receive the money without any hassle, you will need to provide your recipient’s details.

Money Received in India: Documents Required

- Transfer Number– Money is always transferred to you with a reference number; you need it to confirm it.

- Govt ID– You will also need a government I.DI.D to receive money at your location.

- Amount Received– Be sure to know the exact amount received.

- Sender Details– To receive the money, you must have the sender’s details.

What is the cost of transferring money from the USA to India?

- Exchange Rates– The exchange rate is the amount received by your recipient after the deduction of the charges, and you need to determine which service provider offers the best exchange rate.

- Transfer Fee– A money transfer transaction is generally subject to a fee, either a flat rate or a percentage of the amount you send.

- Transfer Speed– It is very important to know how long it takes to transfer your money. There are times when we need to transfer money for an important task; in that case, determine who can transfer it the fastest.

- Transfer Limit– Additionally, this parameter is important since some services have a limit of only $10,000. Others offer the same limit of $1 million, so you need to decide if you want to do a small or big transaction, even with a low fee.

Money transfers from the U.S.A. to India: what is the best exchange rate?

First, it might seem challenging to decide when to send money and which company to use for your U.S. to India transfers, especially since remittance exchange rates are constantly changing and there are countless new companies and startups to send money abroad.

You can easily compare many options, so you can make an informed decision quickly and easily. You can compare different banks, foreign exchange specialists, Fintech startups, remittance service providers, multi-currency bank accounts, and others in one place to maximize your return on international USD to Indian Rupee transfers.

Our RemitFinder exchange rate alert can help you save time and money. We keep you updated on the latest exchange rates between the United States Dollar and Indian Rupee, as well as ongoing promotions.

How can I send money from the U.S.A. to India through a bank?

Your first thought when sending money overseas may be to rely on your bank to process your U.S.A. to India money transfer. While it is convenient to use your bank (you already have an account and can even initiate the transfer from home using mobile banking), you should also compare other options.

Many financial transactions have also moved online due to the increased penetration of the internet into our lives. We can, for example, pay our bills, buy all types of commodities, book our vacations, and enjoy all types of entertainment online. Consequently, it is not surprising that the global remittance ecosystem has a significant digital footprint. This is especially true for markets such as USD to INR transfers.

Money transfer companies often offer better exchange rates than your bank and lower fees. Therefore, you can send money to India in addition to your U.S.U.S. bank account. You would be able to maximize the value of your United States Dollar even more so that your recipient in India receives the maximum amount.

Conclusion

The information in this article covers almost everything you need to know about transferring money from the U.S.A. to India. In addition to the procedure, we’ve compared different services based on speed and cost, especially the overall winner. We hope you find this article helpful.

FAQs

Is it possible to transfer international money online?

HDFC Bank’s RemitNow platform enables you to send money internationally from the comfort of your home or office. Foreign outward remittances are now as easy to transfer as RTGS/NEFT. Directly you can send money overseas and smile at the same time. Anywhere, anytime.

Is it possible to transfer money internationally from my bank account?

Your loved ones overseas can receive money from your bank account. There is no fee for sending money overseas. You can use it to send money just as fast and as reliable as using your bank.

How can I transfer money internationally at the cheapest rate?

A specialist money transfer service is almost always the cheapest way to transfer money internationally. Since they offer more competitive rates, fees, and commissions than banks or PayPal, your recipient will end up with more money.

Is it possible to send money to the USA from India?

You can send money from India to the US using Western Union’s online service. Register on their website to initiate the transfer and pay via your bank account. Your recipient will receive the money directly in their bank account. The service takes one business day, and the transaction can be tracked online.