Rules of 70 – Definition

Rule; It is calculated by dividing 70 by the number of years it takes to double your money or investment. Given a certain rate of return, your money will double after 70 years if you follow the Rule of 70. When comparing investments with different annual compound interest rates, this Rule is commonly used to determine how long a particular investment will grow. The Rule is also known as the “doubling time.”

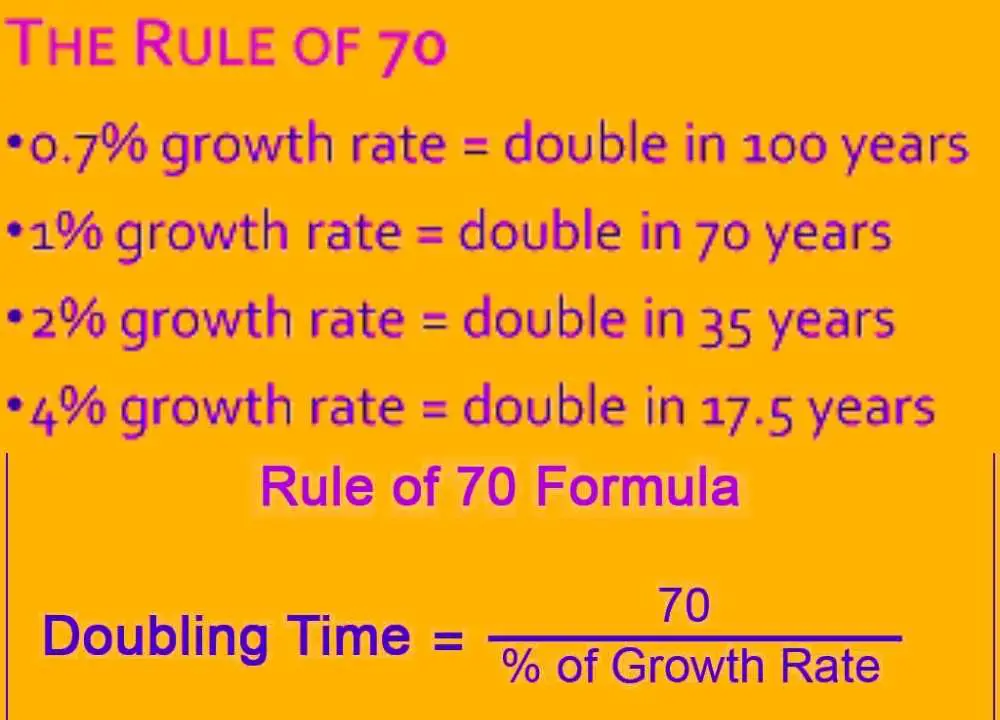

Is there a formula for the Rule of 70?

In [Number of Years to Double] = / frac [70] [/ text [Annual Rate of Return]

The number of years it will take to double is

Annual Rate of Return 70

Calculating the Rule of 70

- Calculate the annual rate of return or growth rate for investment or variable.

- Divide 70 by the annual growth rate.

Do You Know What the Rule of 70 Means?

A rule of 70 can be used to determine what an investment may be worth in the future. The Rule effectively determines how many years it will take for an investment to double, even though it is a rough estimate.

Investors can use these metrics to evaluate various investments, such as mutual fund returns and growth rates for retire-early portfolios. If a calculation predicts that a portfolio will take 15 years to double, an investor who wants a result closer to 10 years can make allocation changes to the portfolio to increase the growth rate.

Using the Rule of 70, exponential growth concepts can be managed without complex mathematical procedures. In examining the potential growth rate of an investment, it is most often related to items in the financial sector. The number 70 can be converted into a year estimate by dividing it by the expected rate of growth or return on financial transactions.

READ ALSO:- Retire early with real estate

What Is the Difference Between Rule of 70 and Rule of 72?

By using the Rule of 70 and the Rule of 72, we can estimate the number of years it would take for a variable to double. In order to calculate using the Rule of 70, the number 70 is used. The number 72 is also used in the calculation when using the Rule of 72.

‘Rule of 70.’

Using the Rule of 70, we can calculate the number of years it takes for a variable to double by dividing 70 by the growth rate of the variable. An investment’s annual rate of return is generally used to determine how long it will take for it to double, based on the Rule of 70.

Assume, for instance, that an investor invests $10,000 at a fixed annual interest rate of 10%. When will his investment reach $20,000? Using the Rule of 70, he calculates that his investment will take about seven (70/10) years to double.

Rules of 72

By applying the Rule of 72, you can calculate how long it would take for an investment to double at a fixed annual interest rate. The Rule of 72 is found by dividing 72 by the annual rate of return.

As an example, assume an investor invests $20,000 at a 10% fixed annual interest rate. How long will it take the investor’s investment to double? His investment would double within 7.2 (72/10) years if he applied the Rule of 72 instead of the Rule of 70.

Describe the Rule of 70.

According to the Rule of 70, a person’s money or investment will double after 70 years. Normally, the Rule of 70 is used to calculate how long it might take to double the money at a certain rate of return. Investments with different compounded annual interest rates are often compared using this Rule. You can then calculate how long it would take to see the investment grow quickly. Financial investors sometimes refer to the Rule of 70 as the doubling time.

Using the Formula

What is the 70-rule? There is a specific formula. Divide 70 by the annual return rate to see how many years it would take to double the investment.

Calculating the Rule of 70

- An annual growth rate or return rate on investment or variable is imperative.

- Divide the annual growth rate or yield by 70 to see the results.

Limitations of the Rule of 70

Generally, the Rule of 70 works well. However, the answer may not be entirely accurate for a variety of reasons.

It assumes that something is continuously compounded. Therefore, interest is continually calculated and added to the account. Most savings accounts compound interest monthly rather than continuously. Even a regular CD is compounded only once a month, so it is not truly continuous. There’s usually a set interest rate, and the investor doesn’t change it during the term. In that case, the Rule of 70 slightly underestimates how long it takes for it to grow.

Compared to small annual growth rates, the difference becomes apparent at higher rates, such as 10 percent or more. This is important if the investor is estimating the growth of investments, such as mutual funds or stocks.

A change in the account balance can also change those calculations, especially if there are large withdrawals or deposits within the time period.

For the lifetime of the investment, the Rule of 70 assumes a constant growth rate. Savings accounts usually won’t change their interest rates, but it is possible. An investment or stock portfolio can grow and return at a different rate every year. That’s why it’s nearly impossible to predict its performance. Whenever the annual rate of return changes, it is best to recalculate.

To a certain extent, the Rule of 70 and the Rule of doubling include estimates of growth rates or rates of return on investments. The results can therefore be inaccurate.

Application for the Rule of 70 in other fields

Other applications of the Rule of 70 exist as well. You can calculate how long it might take for a country’s real GDP (gross domestic product) to double. Calculating compound interest rates are similar. Divide the GDP growth rate by 70. As an example, China has a growth rate of ten percent. A rule of 70 predicts that it might take seven years for the real GDP in China to double (70/10).

Rule of 70 examples

The investor wants to find out how long it will take to double their retirement portfolio, based on the various rates of return. Investment options make sense for future value and are related to growth rates.

The following are various calculations based on different growth rates:

- For a portfolio to double at a 3 percent growth rate, it would take 23.3 years (70/3).

- It takes 14 years to double at a 5 percent growth rate (70/5).

- It takes 8.75 years to double at an 8 percent growth rate (70/8).

- It takes seven years to double at a 10 percent growth rate (70/10).

- It takes 5.8 years to double at a growth rate of 12 percent (70/12).

Is there a difference between the Rule of 70 and compound interest?

From the initial principal, compound interest is calculated. This includes the interest accumulated on the loan or deposit in previous periods. Compounded interest is typically calculated according to its frequency. Compound interest accrues on future investments when the number of compounding periods is higher.

Calculating compound interest for doubling time is essential. In this way, the number of years and the value of the investment are known if the interest is compounded according to this Rule, the investment doubles in size.

What is the Rule of 70?

The “Rule of 70,” or also known as doubling time refers to the amount of time needed to double the quantity or value (we have taken money). If all other factors remain unchanged, it simply means that it will take how long for our money or investments to double. How long will it take for our $100 to double, e.g., become $200, at a growth rate of 5% per year? This method is also known as doubling time or, in simple terms, the time required to double a sum.

Rule of 70 Formula

This article will discuss the formula for calculating Doubling time based on the Rule of 70, which is expressed as 70 divided by the growth rate. Mathematically, it is expressed as:

Doubling Time = 70 / % of Growth Rate

Calculation of growth rate

Therefore, we need to apply the following formula:

In this example, growth rate (per year) equals (Amount Received at maturity minus AmountAmount Invested) divided by Amount invested thereafter divided by 365 days / 12 months divided by period of investment. Mathematically, it is as follows:

The growth rate is calculated by taking the difference between the Amount received, and the Amount invested and dividing it by 365 days or 12 months / Period of Investment * 100 (always in percentages).

Explanation

Using the following steps, we can derive the equation for Rule of 70:

Step 1: Determine the number of investments and the period of investments.

Step 2: Next, calculate the return on investment by subtracting the AmountAmount invested from the AmountAmount received on maturity (called “Return”).

Step 3: Next, determine the period of investment that produced returns or capital appreciation, that is, the period from when the investment was made to the time of maturity, or “T.”

Step 4: Using the formula mentioned above, calculate the growth rate of the investment referred to as “G.”

Step 5: Using the formula mentioned above, we can easily calculate Doubling Time. Using the formula in Step 4, we calculate Doubling Time.

Doubling Time = 70% / % of Growth Rate (g)

Comparison of the Rule Of 70 and The Rule Of 72

Normally, the Rule Of 70 is only explained in terms of positive growth rates. Essentially, divide the growth rate (expressed as a percentage) for a given period by 70. You will get the crude population doubling period for that population (expressed in the same time units as the rate).

Similarly, the Rule Of 72 is used in finance, except you divide the rate by 72 rather than 70. As opposed to calculating a population doubling period, you would typically calculate an investment doubling period. The Rule Of 72 is probably preferred in finance to the Rule Of 70 because 72 has more whole number divisors (72, 36, 24, 18, 12, 9, 8, and 1) than 70 (70, 35, 14, 10, 7 and 1). Thus, the Rule of 72 is easier to explain to potential customers than the Rule of 70.

“Rules 72 and 69”

Occasionally, the Rule of 72 or the Rule of 69 is used. In the calculations, the Rule of 70 is replaced by 72 or 69, respectively, instead of 70. Generally, the Rule of 69 is considered more accurate for continuous compounding processes, whereas the Rule of 72 may be more accurate for less frequent compounding intervals. This Rule is popular because it is easy to remember.

FAQs

Is there a rule of 70 examples?

Taking 70 years to double a country’s economy is equal to the percent growth rate divided by 70 years.

As an example, = Approximately 70 / 1 = 70 years will pass before the size of an economy doubles.

What is the 70 doubling rule?

Using the Rule of 70, we can calculate the number of years it takes for a variable to double by dividing 70 by the growth rate of the variable. In general, the Rule of 70 is used to determine how long it will take an investment to double, given its annual return.

What does the 70% rule for retirement mean?

The Rule of thumb is that in retirement, you’ll need 70 percent of the income you earned during your working years.

How does the Rule of 70 work in the economics Quizlet?

How does the Rule of 70 work? Using this formula, we can calculate how many years it will take for the real GDP per capita of any other variable to double. The quantity of capital per hour worked and the level of technology.

Conclusion

To calculate the doubling time for various growth rates, the rule of 70 is used. To determine the time needed for your business or product idea to double, divide 100 by the annual percentage change you have in mind and multiply this number by 2 (or whatever the number is). An investor seeking to know when their investment might return $2 million dollars with an 8% annual increase in value might use the following equation: 100/8=12.5; 12.5*2 = $25,000.