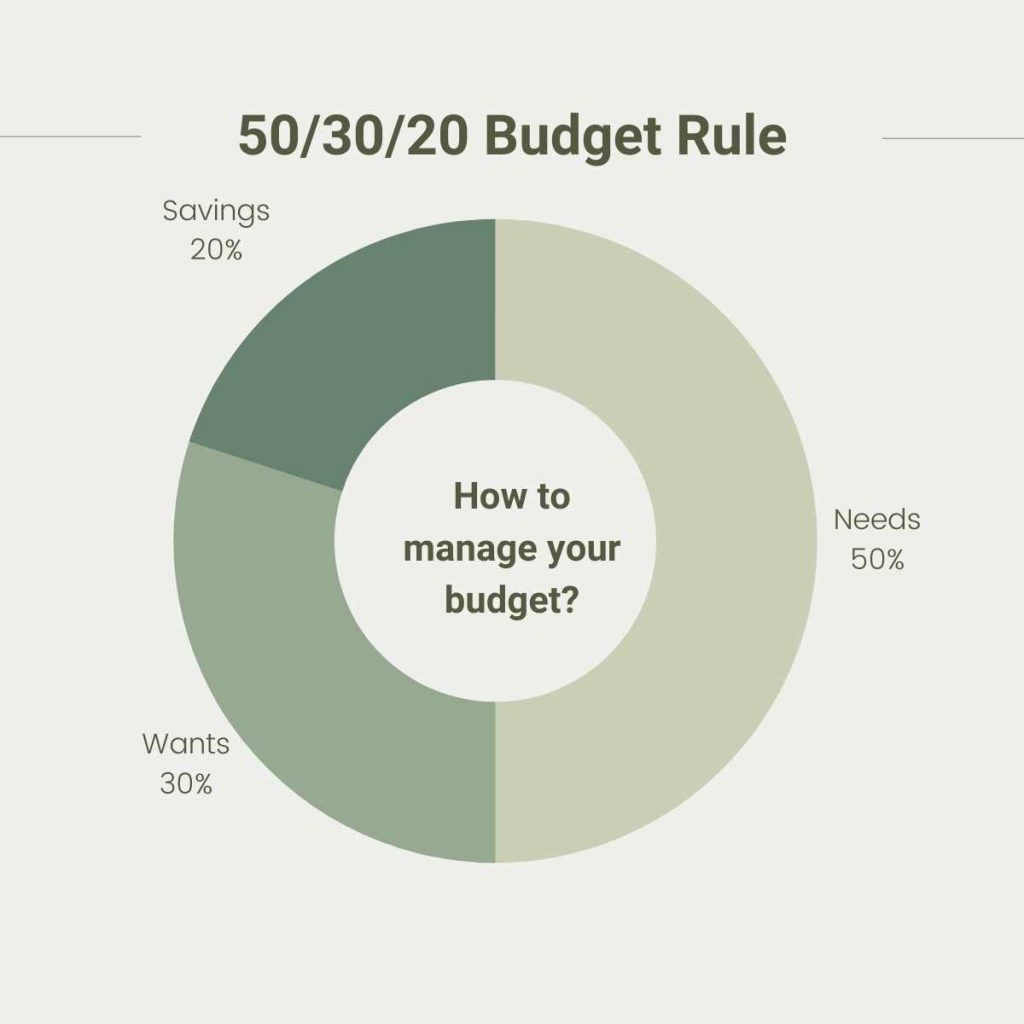

A 50/30/20 budget rule of thumb is a way to allocate your budget based on needs, wants, and financial goals. It isn’t a strict rule but rather a rough guideline that will help you build Financially sound budgeting tips.

Example. We’ll show you how and why you can set up a budget for yourself based on the 50/30/20 rule.

What does the 50/30/20 rule mean?

Using the 50/30/20 rule, you allocate your after-tax income according to these guidelines.

50% of Needs

There is no way to live without your needs, or at least not very easily. Examples include:

| paying rent | and buying groceries |

| and utilities, such as electricity, water, and sewer service |

30% to Wants

These are things you desire but don’t actually need to survive. They may include:

| Hobbies | Vacations |

| Going out to eat | Netflix, Hulu, and other streaming services |

20% to Financial Goals

This category covers two main topics:

| Savings for retirement, saving for a house and setting up a 529 college savings plan come from pre-tax income (note that 401(k) contributions come from post-tax income) |

| Payments on debt Since this is only a guideline for planning your budget, you’ll need to add a budget tracker, such as YNAB (You Need a Budget), Mint, or Quicken, to monitor spending. You can set the 50/30/20 percentages as targets in whatever budget tracker you use. |

Who Originated the 50/30/20 Rule of Thumb?

The 50/30/20 rule was popularised in the book All Your Worth: The Ultimate Lifetime Money Plan written by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi. For working-class families, it was designed to help them plan their spending in order to prepare for the future.

READ ALSO:- save money Tips for college students

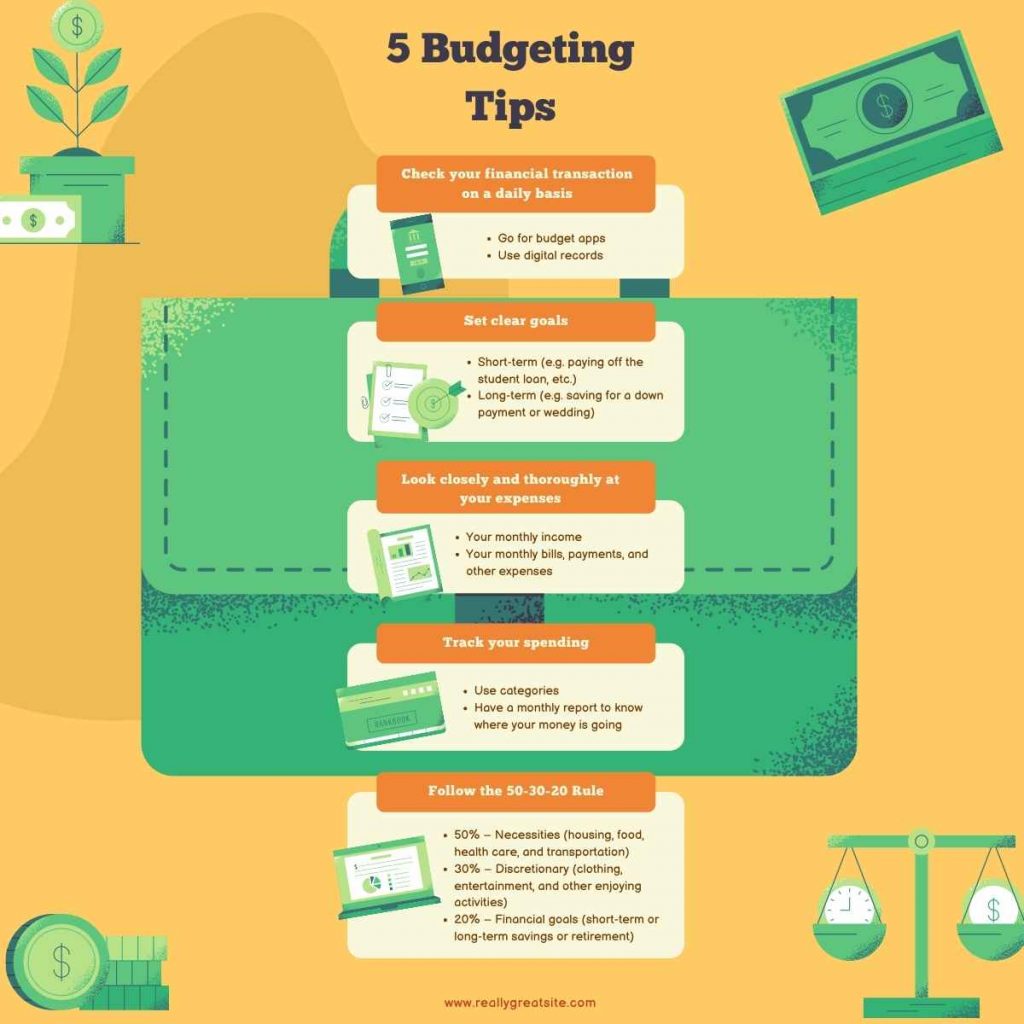

If you’re budgeting, you should follow the 50/30/20 rule.

Many people spend more than they save. You can save more by spending less on the things that don’t matter as much to you. By following the 50/30/20 rule of thumb, you can become aware of your financial habits and limit overspending and undersaving.

The process is as follows:

- Calculate your monthly income as follows: Total up how much you receive in your bank account every month. Estimated taxes are deducted from your take-home pay if you pay them. You can add the amount withheld from your take-home pay if you have a workplace retirement plan.

- Determine a spending threshold for each category: Divide your take-home pay by 0.50 (for needs), 0.30 (for wants), and 0.20 (for financial goals).

- You should plan your budget around these numbers: Imagine the three categories as “buckets” that you can fill with monthly expenses. Add up your monthly expenses by category, and see if you are spending less than the target you established in the previous step.

- You should follow your budget: To stick to your spending thresholds in the future, keep track of your expenses each month, and make necessary changes where necessary.

Here is an example of the 50/30/20 Rule of Thumb

Using the steps above, here’s an example:

1. Example (Calculate your monthly income)

| Calculate your monthly income as follows: Let’s say that you and your spouse have a job deposit of a total of $4,787 into your bank account each month. Both of you check your pay stubs and see that $532 was taken out for 401(k) contributions. Your combined monthly income is $5,319 ($4,787 + $532). |

2. Example (Determine a spending threshold for each category

| Determine a spending threshold for each category: Using the 50/30/20 rule, the amount you should allocate to “needs” is $2,659 ($5,319 x 0.50). It is recommended that you allocate $1,596 to “wants” ($5,319 x 0.30). You should allocate $1,064 to financial goals ($5,319 x 0.20). Since you already contributed $532 to your 401(k)s, the remaining $532 can be used to pay down debt or to save for other financial goals. |

3. Example (Budget based on these numbers)

| Budget based on these numbers: Using your budget, either plan out your spending or review how well it aligns with these targets. |

| Total Monthly Income | $6,300 |

| Needs: $6,300 x 0.50 | $3,150 |

| Wants: $6,300 x 0.30 | $1,890 |

| Goals: $6,300 x 0.20 | $1,260 |

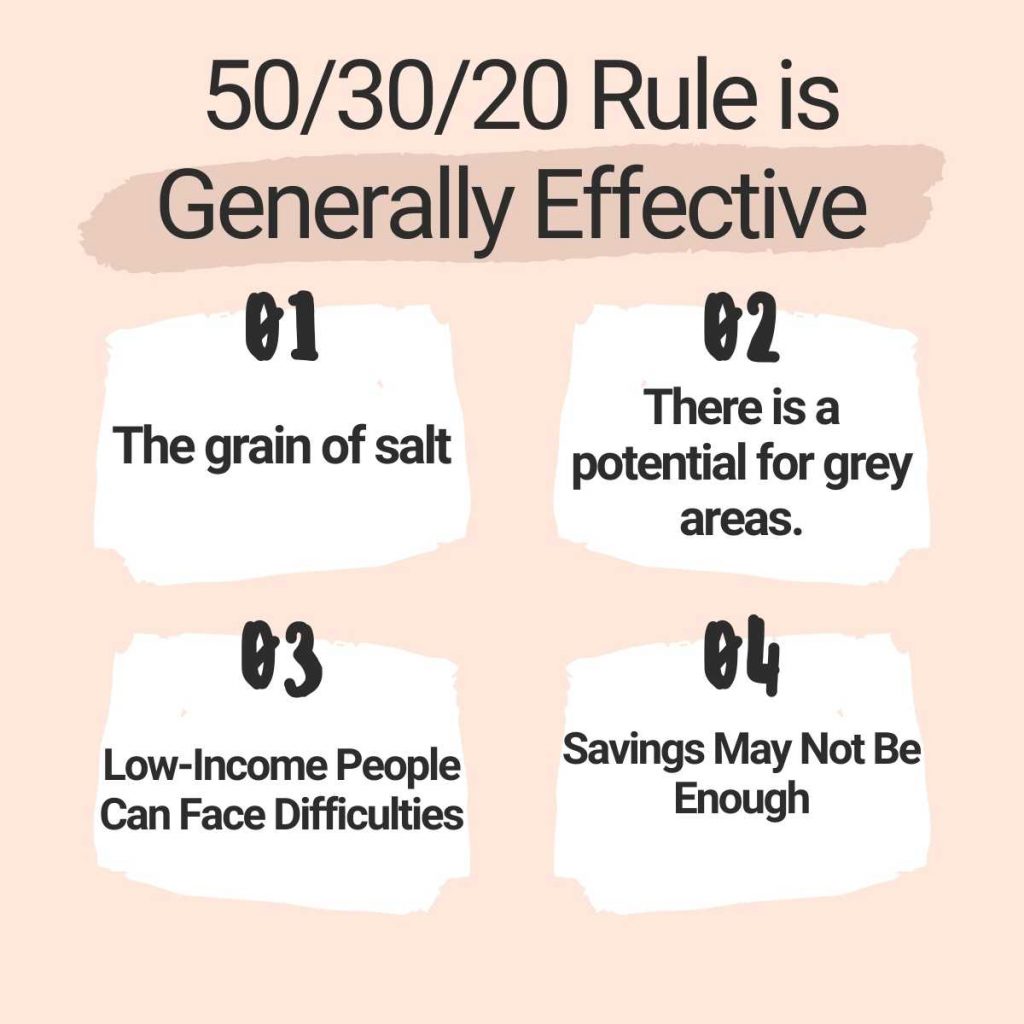

Why the 50/30/20 Rule is Generally Effective

Figuring out your finances can be confusing, and it’s often difficult to know where to start. This is one reason why the 50/30/20 rule of thumb works so well: It makes it easy to handle something that would otherwise be difficult. Even if you don’t track how well you stick to these targets, this is still a good way to gauge your financial health.

The grain of salt

The 50/30/20 rule should be taken with a grain of salt, as with any rule of thumb.

There is a potential for grey areas.

Sorting out your spending based on three categories can sometimes be challenging. As an example, everyone needs to eat, but some groceries fall under the wants category (such as sugary sodas and unhealthy snacks).

Low-Income People Can Face Difficulties

It may be difficult to save 20% of your income if you earn just enough to make ends meet, especially if you support a family.

Savings May Not Be Enough

- However, if you have big goals, such as retiring early or buying a house in a high-income area, 20% might not be enough.

- You would need to save more than two-thirds of the cost of an average home to afford a 20% down payment on a median home in San Francisco, or $200,000 for a 20% down payment.

Tracking your budget is still important.

Budgeting is more complicated than the 50/30/20 rule. If you don’t track your spending, you’ll never know whether you’re actually hitting these percentages.

Other Budgeting Methods vs. the 50/30/20 Rule of Thumb

You don’t have to follow the 50/30/20 rule of thumb. Here are a few other budgeting techniques you might find useful:

- The 80/20 Rule: Using this method, you immediately save 20% of your income. The remaining 80% can be spent however you like, with no tracking required.

- The 70/20/10 rule: Like the 50/30/20 rule, you allocate your budget as follows: 70% living expenses, 20% debt repayments, and 10% savings.

Conclusion

You can start allocating more funds towards saving once you’ve successfully managed and stabilized your lifestyle. However, you should ensure that at least 20% of your post-tax income goes to your savings. This can then be interpreted as a rule of 50% needs, 30% savings, 20% wants, etc.

FAQs

How effective is the 50/30/20 rule?

Your must-haves and must-dos should account for up to 50% of your income after taxes. The remaining half should be split into 20% savings and debt repayment and 30% for everything else.

How does 50/20/30 budgeting work?

The 50-30-20 rule of budgeting one’s income is based upon these three expenses, where one devotes 20 percent of one’s income to savings, 50 percent to important and necessary expenditures, and 30 percent to important but non-necessary expenditures.

In finance, what is the 72 rule?

Rule of 72 is an estimation of how many years it takes to double your money at a specified rate of return. The time it takes your money to double is 72 divided by four if your account earns 4 percent. In this case, it will take 18 years.

Based on the 50/30/20 rule, what percentage of your budget will meet your needs?

A simple budgeting method such as the 50/30/20 rule can help you manage your money more effectively, simply, and sustainably. Divide your monthly after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment