$24 an hour is how much a year, therefore, you will earn $24 an hour from your new promotion or job. How much will you earn a year from $24 an hour? You will find below $24 an hour is how much annually, monthly, weekly, daily, and even after taxes. You can also see an example budget when earning $24 an hour.

Multiplying money of $24 by 40 hours and 52 weeks gives a yearly salary of $24 per Hour. Working 40 hours a week, making $24 an hour, you would earn $49,920 a year if you worked full-time.

An example of comparing $24 an hour (before & after taxes)calculate the money.

| $24 per hour | Pretax Income | After-Tax Income |

| Yearly (52 Weeks) | $49,920 | $37,440 |

| Monthly (160 Hours) | $3,840 | $2,880 |

| Biweekly (80 Hours) | $1,920 | $1,440 |

| Weekly (40 Hours) | $960 | $720 |

| Daily (8 Hours) | $192 | $144 |

| Hourly (1 Hour) | $24 | $18 |

$24 an hour is how much money a year

If you earn $24 an hour, your annual salary would be $49920. Divide your $24 hourly wage by 2,080 total hours worked per year. A full-time job requires you to work 40 hours a week on average, and there are 52 weeks in the year. A total of 2,080 hours is worked in a year by multiplying 40 hours by 52 weeks. If you worked fewer weeks or took some time off, you would earn less than this amount each year.

READ ALSO: $45 an hour is how much a year 2022

After taxes, how much money is $24 an hour after taxes?

Your salary before taxes was $49,920. After taxes, you would earn $37,440 if you earn $24 an hour. After tax, your salary would be $37,440 after paying 25% in taxes. At $24 an hour, about a third to a fourth of your income will go to taxes. There are several ways to minimize taxes. This amount can be assumed as a tax rate for the average person.

How Much is the Hourly money of $24 a Month?

Assuming you are working full-time, you would earn $3,840 a month at $24 an hour. At least 40 hours a week are worked by a full-time employee. This amount will vary a bit if you work more or fewer hours. If you work overtime, you will receive 1.5 times your regular salary. It is possible to earn a lot more than what is mentioned above.

A biweekly wage of $24 an hour is how much?

A biweekly wage of $24 equates to approximately $1,920 before taxes and approximately $1,440 after taxes. After taxes, you would earn $1,440 working full-time at 40 hours a week and paying 25% tax. To find out how much you make biweekly before taxes, you would multiply $24 by 40 hours and 2 weeks.

An Hourly Rate of $24 is How Much a Week?

If you earn $24 an hour, you will earn $960 a week. This amount is calculated assuming you work full-time for all four weeks of the month. A weekly income of $960 is obtained by multiplying 40 hours by $24 an hour.

How much money do 24 dollars an hour cost?

An hourly wage of $24 is $192 per day. A standard workday lasts eight hours. As a result, if you multiply 8 hours by $24 an hour, you would earn $192 every day.

An hourly rate of $24 for 2,000 hours of work.

Consider taking two weeks off each year as unpaid vacation time as a simple baseline calculation. As a result, you would work 50 weeks of the year, and if you work a typical 40-hour week, you would have 2,000 hours of work each year.

Calculate the annual salary by multiplying the hourly wage by 2000. An hourly wage of 24 dollars corresponds to an average annual income of $48,000.

What will be the total number of working days in 2022?

- In order to be even more precise, you can count the number of working days this year. In 2022, the year begins on a Saturday (January 1, 2022) and ends on a Saturday (December 31, 2022).

- There are 365 days in the year, including weekdays and weekends. There are 105 weekend days (Saturdays and Sundays) during the year and 260 weekdays (Monday through Friday).

- The total number of hours you would have worked over the course of the 2022 year would be 2,080 hours if you worked 8 hours per day on each weekday and no overtime on the weekends. You can then convert your hourly pay into a yearly salary of approximately $49920.

- If your company switched your pay from hourly to salary, you might get paid $49,920 per year, but you wouldn’t have to work 2,080 hours since some days would be holidays. Therefore, your yearly income wouldn’t necessarily change, but you might work fewer hours over the year. Remember that most companies give their employees holiday time off, so you should also factor that in.

How much money do I earn each day?

If you work an eight-hour day, you will multiply your hourly wage by eight to find your daily rate. Earning 24 dollars an hour equals $192 a day.

How about every week?

In this case, you would make $960 per week if you worked 40 hours per week.

What are the chances of making a lot of money in a fast a month?

Based on an average month of four weeks, A monthly salary of $3,840 can be calculated from earning 24 dollars per Hour. It is important to note that some months are longer than others, so this is just a rough average. You can estimate how much you make each month by multiplying your annual salary by 12 months.

For example, if your annual total is $49920 per year, your average monthly wage would be $4160.

How much money is $24 an hour in a month?

You need to know how many working hours are in a month if you want to calculate how much $24 an hour is. We can determine how many working hours are in a month by dividing the total working time in a year by 12 (months). An average of 175 working hours per month is equal to 2,096 hours per year divided by 12.

Here is how you can calculate your monthly income: At an hourly rate of $24, multiply 175 hours a month by $4,200 to get an average monthly income of $4,200.

A week’s worth of $24 is how much?

We will assume you work a 40-hour week if you want to break it down by week. Here is how you can calculate your weekly income: $24 an hour multiplied by 40 hours per week is $960 per week income.

How Much Money Is $24 An Hour Per Day?

Let’s see how much you can make per day on $24 an hour. Assuming you are working a typical 8-hour workday, here’s the answer: $24 an hour multiplied by 8 hours per day is $192 per day income.

$24 Per Hour Comparison Table

| $24 An Hour | Total Income |

| Annually (52 weeks) | $49,920 |

| Annually (50 weeks) | $48,000 |

| Annually (262 working days) | $50,304 |

| Every month (175 hours) | $4,200 |

| Every week (40 hours) | $960 |

| Daily (5 Hours) | $120 |

| Daily (8 Hours) | $192 |

| Daily (10 Hours) | $240 |

| Monthly Take Home (175 Hours) | $3,333 |

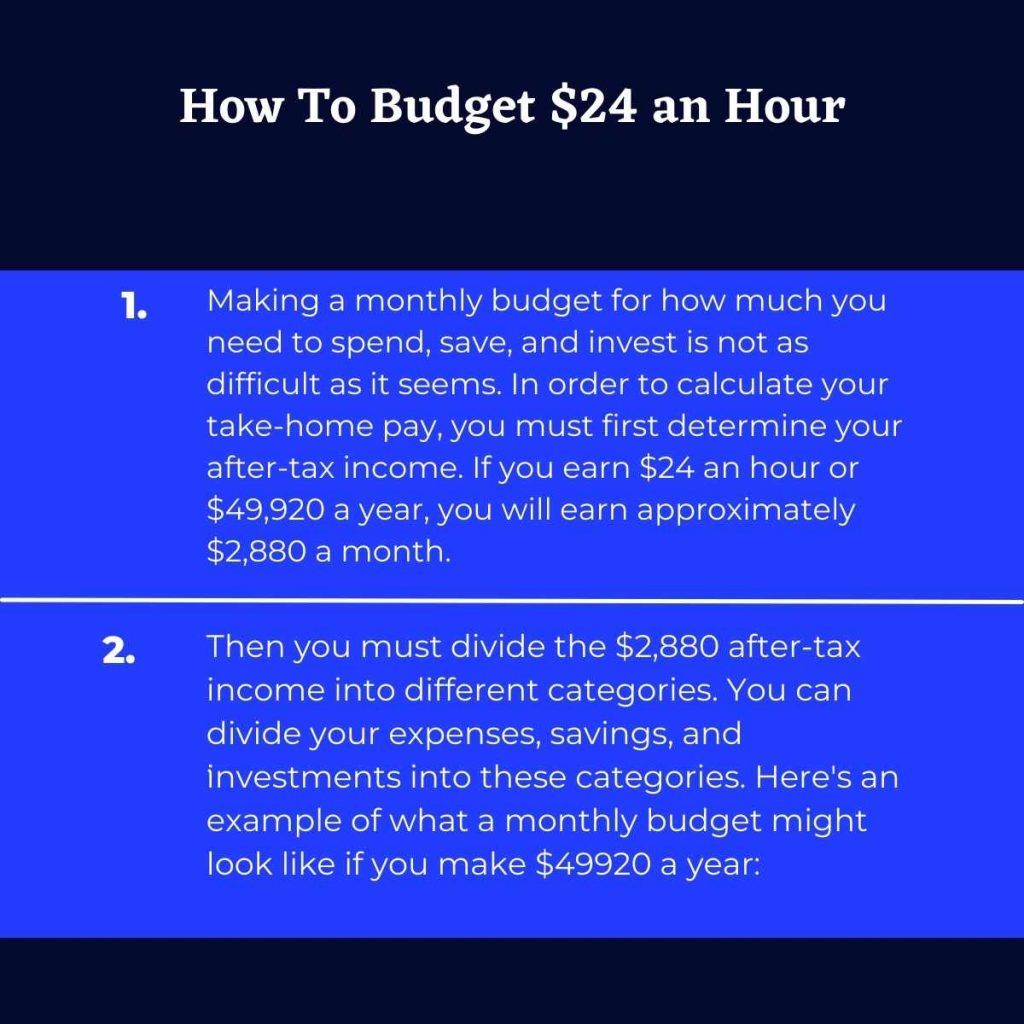

An Example Budget of $24 Per Hour

Let’s see how making $24 an hour can affect a typical budget. Having established how much you can earn annually, monthly, and weekly, let’s take a look at a typical budget. For your Budget, you must estimate your take-home pay. By subtracting taxes from the $4,200 monthly income of $24 an hour, the estimated take-home pay is $3,333 (depends on the state and paycheck deductions).

An example monthly budget for $24 an hour is as follows:

| Category | Budget | Percentage |

| Income | $4,444 | |

| Giving | $444 | 10% |

| Investing and Saving | $444 | 10% |

| Food | $444 | 10% |

| Utilities | $444 | 10% |

| Housing Costs | $1,111 | 25% |

| Transportation | $444 | 10% |

| Health | $444 | 10% |

| An insurance policy | $444 | 10% |

| Personal Expenses | $222 | 5% |

| Total Expenses | $4,444 |

This is a comfortable budget and would be great for a single person or married couple, possibly renting an apartment.

A person earning $24 per Hour can buy a house if they make sure to put 20% down and keep their costs under $850 per month. Additionally, you can still save over $300 per month. The money should go to your 401k, investing toward retirement with your company match. Don’t you like the Budget? Take a look at the budget template below and enter your numbers for a $ 24 an hour budget.

The $24 an hour salary is how much does it mean?

A person earning $24 an hour earns $49,920 a year. Typically, a full-time worker works 40 hours per week. Since there are 52 weeks in a year, you can multiply 24 dollars An income of this level will result in taxes of roughly 25%. As a result, you’ll earn about $37,440 after taxes.

24 dollars an hour is how much does part-time work cost?

24 dollars a year, part-time earnings are between $24,960 and $43,680. If someone works 20 hours a week for 52 weeks, they will earn $480 per week or $24,960 per year. Alternatively, if you work 35 hours a week, which is still considered part-time, you will earn $840 a week or $43,680 a year.

Here are the tools you need to survive on $24 an hour

A salary of $24 per hour is quite impressive. Saving, investing, and making more than this amount is even more impressive. Too much financial preparation is never a good thing. However, many people think personal finance is much more complicated than it actually is when they hear the term. It’s easy to have a better financial future today than it was yesterday with these cashback tools. This holds true regardless of your experience level with personal finance. The following tools can help you survive on $24 an hour.

1. Times club

Times club USA is giving $20 per referral. You can refer up to 50 people and get up to $1,000 rewards. Rewards automatically will be added to your Times club account, and you can en-cash any time. Times Club is now giving a $20 sign-up bonus and a $20 referral bonus. Earn $100 for 5 successful referrals on Times Club Plus and a $100 extra bonus for completing 5 referrals.

2. RebatesMe

RebatesMe Signup Bonus | Get $30 & $10 for Referrals (Unlimited).Do you earn money while shopping? Yes, you can earn cashback in online shopping from your favorite stores through RebatesMe. You will also earn a $30 Rebatesme signup bonus if you subscribe today.

3. Coinchange

The Coinchange signup Bonus is $40, and the Referral Bonus is $40. Refer a friend and earn $40 with the Coinchange Referral Program. Referring your friends to coin change and they create a verified account, you will receive $40 for every verified signup. Please share your referral link with your family and friends to earn referral rewards

4. Paceline credit card

Paceline credit card bonus offer. cardholders of the Paceline credit card can:

- You can earn 5% unlimited cash back on eligible health and wellness purchases, including gym memberships, fitness classes, fitness equipment, and apparel, groceries, drug stores, and pharmacies

- All other eligible purchases will earn 3% unlimited cashback

If you multiply 40 hours by 50 weeks, you will have worked 2,000 hours in a year. The hourly rate is determined by multiplying it by the total number of hours worked in the year. An income of $70,000 would be earned by earning $35 per hour for 2,000 hours of work per year.

5. PayPal

PayPal refers a friend you can now signup for the Paypal Referral program and earns up to $50 in referral rewards.

Is $24 an Hour Good Pay or not?

It is good to pay to make 24 dollars per Hour. This hourly rate increases as you work more hours. Consider, for example, a two-week pay period. Working 20 hours a week at 24 dollars an hour, you would earn $960 before taxes.

You would earn $1,920 before taxes every two weeks if you worked full-time. You would earn approximately $1,440 after taxes.

What is the after-tax value of $24 an hour?

- 24 dollars an hour before taxes equals 18 dollars an hour after taxes. Adding a 25% tax rate to the $24 hourly rate, you will find your after-tax hourly rate is $6 less than your pre-tax hourly rate. Before taxes, you will earn 24 dollars an hour.

- For every $24 you earn, you will take home only $18 after taxes. As soon as you understand this to be the case, you can multiply your after-tax hourly pay number by how many hours you worked to determine your after-tax pay.

- As an example, say you worked 30 hours at your job one week. Multiply your after-tax hourly wage of $18 by 30 hours to calculate your pay for that week. You would make $540 after taxes if you multiplied those two numbers together.

Conclusion

You multiply $24 by 40 hours and four weeks if you want to calculate 24 dollars an hour monthly. $24 divided by 40 hours and two weeks equals $24 per Hour biweekly. Take $24 multiplied by 40 hours weekly. A full-time worker is considered to work 40 hours each week. Finally, $24 an hour equals 8 hours times $24 equals $24. Because the standard workday is eight hours, that amount of time is used in the calculation.

FAQs

What do you think about 24 bucks an hour?

The median household income in the United States was approximately $46,800, or $900 per 40-hour workweek. A wage of $22.50 per hour represents the median household income in the United States. In all likelihood, $24 per hour would be slightly above the median household income in the US.

What are 50 000 dollars money an hour?

$50k is approximately $24.51 per hour, but converting annual salary to hourly pay is not as straightforward as it may seem.

What is a good salary for 65k or not?

It is considered a high income in many parts of the United States but low in other areas. In a room with a low cost of living, $65,000 may easily cover your budget needs, but it may just cover your basics in an area with a high cost of living.