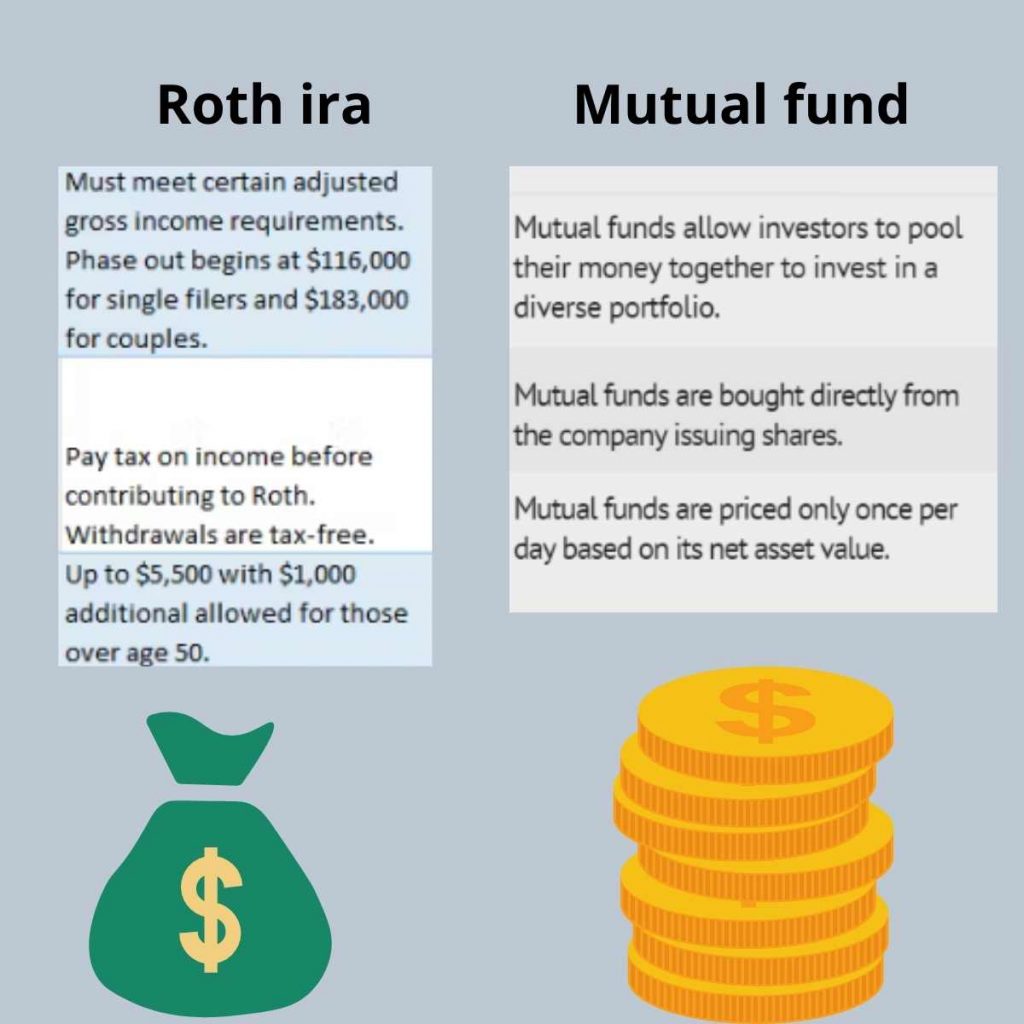

Roth ira vs. mutual fund IRAs can hold cash, stocks, and Mutual funds and Roth IRAs are distinct products, but you can still compare them. As you build an investment portfolio, you have a lot of options to consider, and a financial advisor’s insight can be extremely valuable.

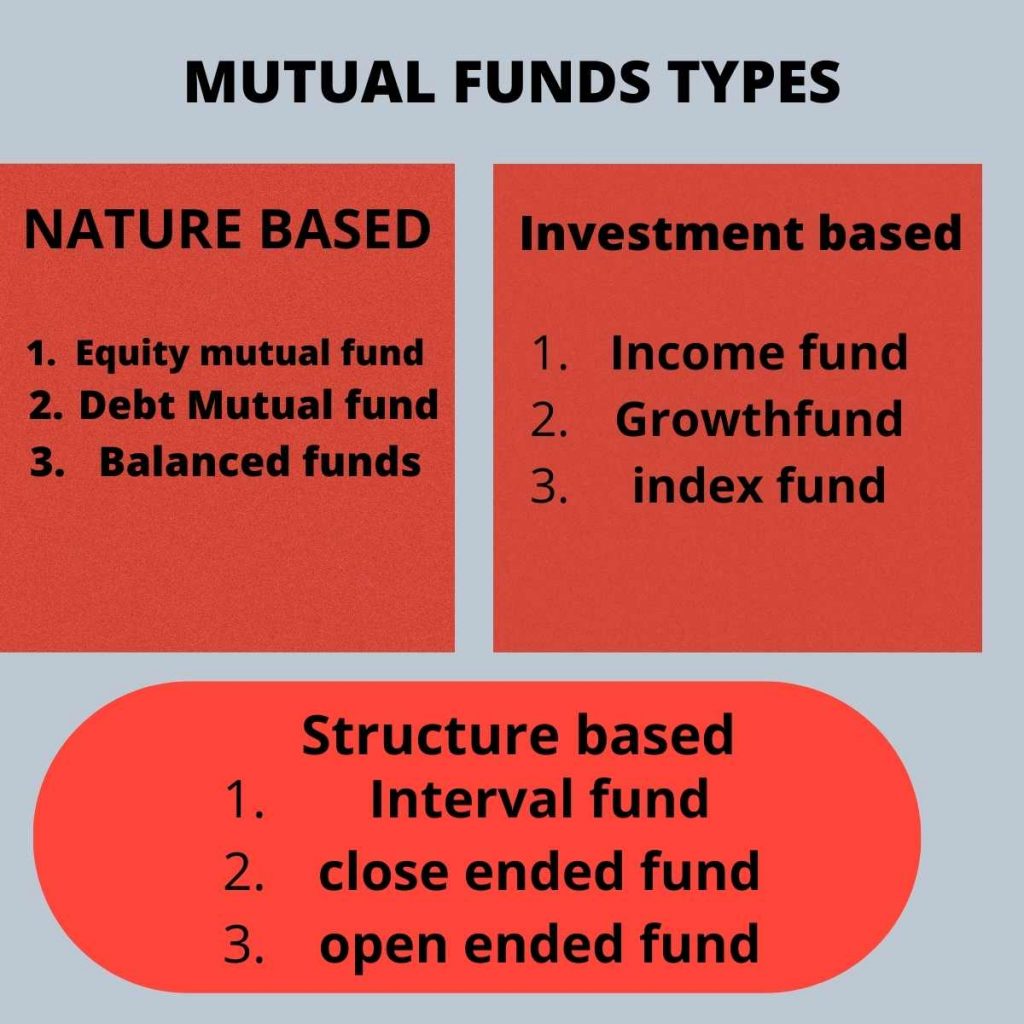

Mutual funds are specific investments made up of a variety of holdings. A mutual fund creates and maintains a portfolio by collecting money from investors.

READ ALSO:- Roth ira vs traditional ira

Mutual Funds

A mutual fund allows investors to invest in a variety of securities, including stocks, bonds, and other assets. Investing strategies are created by a professional money manager, making the funds easier to track and access. Securities are also bought and sold at their discretion.

Multipliers come together to invest their money in a mutual fund, which is a pooled investment. A mutual fund may hold stocks, bonds, commodities, precious metals, and real estate investments.

The assets of a passive fund are less likely to change hands because the manager is less hands-on. Rather than beating the market, passive funds match the performance of an index or benchmark, such as the S&P 500. In general, passive funds have lower expense ratios than active funds, which allows them to produce consistent returns over time.

READ ALSO:- hedge fund vs mutual fund

Roth IRA,

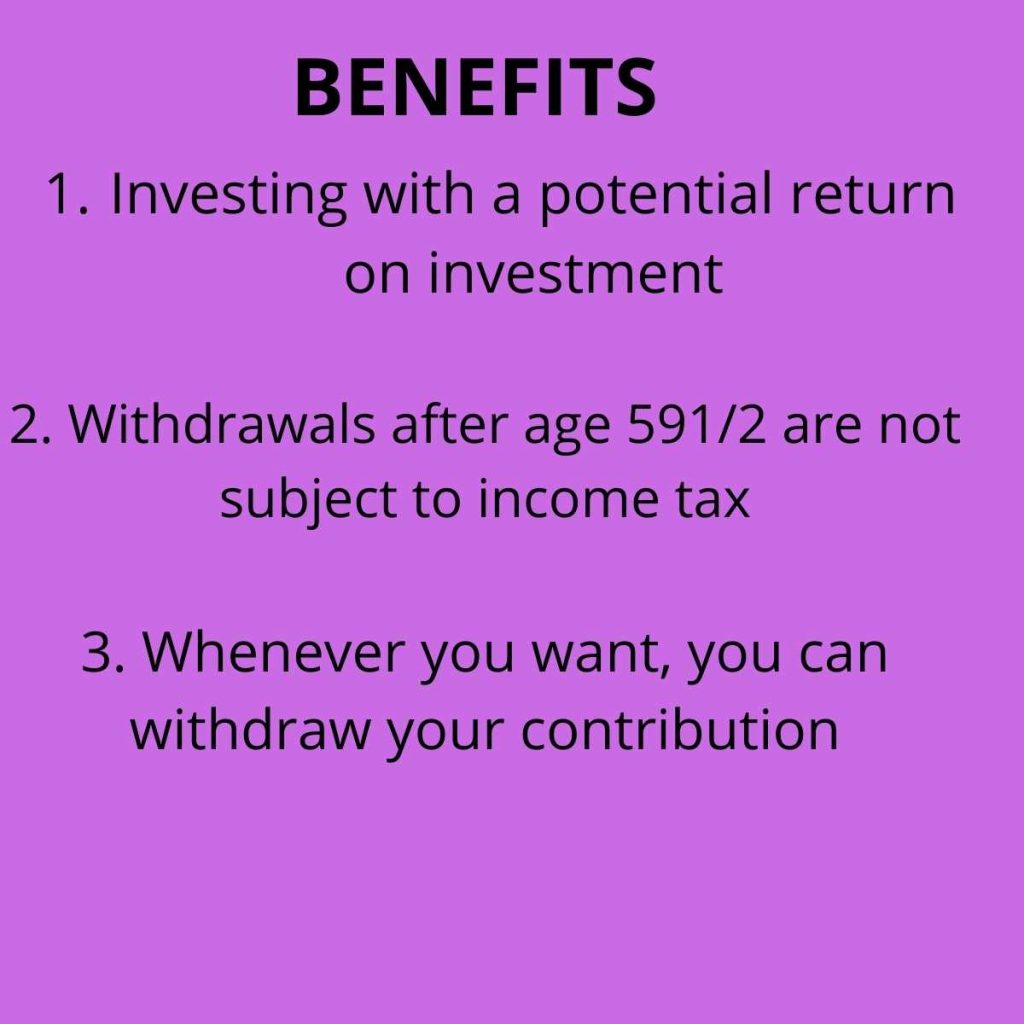

You can save up to a specified amount of after-tax income in Roth Individual Retirement Accounts. Interest, dividends, and capital gains are all tax-free contributions. You are only allowed to withdraw profits if you are at least 59 1/2 years old. In such a case, you will be subject to a 10% tax penalty.

Individuals 48 years and under are limited to $6,000 in contributions; individuals 50 years and older are limited to $7,000 in contributions. It’s also important to remember that contributions are only based on earned income. Any income that is not earned is considered unearned income, including child support payments, social security benefits, rental income, and alimony payments. Earnings from self-employment, wages, salaries, commissions, and commissions all fall into this category.

There is no tax on qualified withdrawals from a Roth IRA, which is perhaps its best feature. After-tax dollars are used to fund these accounts. You don’t have to pay tax on the money again when you withdraw it from your Roth IRA since you already paid tax when you added it to it.

Roth ira vs. mutual fund

| some points | Roth Ira | Mutual fund |

| Process | Submit or send an application online or offline. Your account is opened by the firm you choose. The only thing you have in an IRA is your initial cash contribution, which is likely a money market fund. IRA investments are virtually limitless; | There are many ways to invest, such as stocks, bonds, mutual funds, commodities, certificates of deposit, etc. Mutual funds invest your contributions immediately in shares. |

| Categories | IRA accounts fall into two categories: Roth IRAs and traditional IRAs. Both types provide tax benefits. Although IRAs were intended as retirement savings vehicles, they can also be used for other purposes. | No obvious tax benefits are associated with mutual funds that are not held within an IRA. Mutual funds come in literally thousands of varieties. There are some that mimic the returns of indexes, such as the Dow Jones Industrial Average and S&P 500. Many focus on particular regions or sectors, such as Japan, Asia, the United States, or Canada, or on certain sectors of the economy, such as telecommunications, technology, or consumer products. |

| Uses | The federal government created IRAs to help Americans save for retirement. IRA money can also be accessed early, without penalty, and sometimes even with favorable tax treatment. It’s the same thing, of course. | 2. Money is not held in an IRA account but in a mutual fund. As noted above, your earnings do not grow tax-deferred when you sell mutual fund shares. The process does not provide you with any special benefits, however. |

| Taxes | The tax benefits of IRAs are the most commonly known aspect of them. Roth contributions are not deductible, but they are also tax and penalty-free. You can withdraw all Roth proceeds, including earnings, tax, and penalty-free once you reach 59 1/2 and have held your Roth account for at least five years. The IRS always taxed traditional IRA withdrawals, regardless of age or circumstances. | These tax benefits are not available to mutual funds unless they are held in an IRA. They usually trigger taxable events. You must report and pay taxes on capital gains if you sell mutual fund shares. Shareholders receive distributions when the fund sells shares of holdings it owns or receives dividends from stocks it owns. These distributions must be reported and taxed. Mutual fund earnings grow tax-deferred in an IRA, which means you don’t have to pay taxes on them every year. If you have a Roth IRA, you may never have to pay taxes on the proceeds, |

Which is better, a Roth IRA or a mutual fund?

When it comes to investing, Roth IRAs and mutual funds aren’t mutually exclusive. Investments such as mutual funds play an important role in asset allocation. Roth IRAs can be used for holding such investments; in other words, they are an asset location option. Mutual funds can be included in a Roth IRA portfolio alongside investments in a 401(k)

Roth IRAs can be opened with:

| Companies that provide mutual funds | Credit unions and banks |

| Brokerages online | Companies offering insurance |

| Direct stock purchase plans |

You may be able to purchase mutual funds through any of those. It is important to note, however, that some of these entities may offer Roth IRA CDs in place of regular Roth IRAs. Despite CDs being among the safest investments, you may not earn the same returns with a Roth IRA CD as you would with a regular Roth IRA invested in mutual funds or other securities.

Roth IRAs and mutual funds are great investments.

You may be eligible to open a Roth IRA, depending on your income and tax filing status. Choosing a bank to open your account is the next step if you meet the MAGI guidelines. A taxable brokerage account can also be opened at the same time, giving you more investment options.

Tax efficiency and turnover ratios should be considered when choosing mutual funds for Roth IRAs. Roth IRAs are already tax-favored, so actively managed funds with frequent asset turnover and capital gains events can help minimize your investment tax.

A passive or active management strategy can be used with these products. The turnover of passively managed mutual funds is generally lower. Your tax liability on gains from passively managed funds or ETFs can potentially be minimized by keeping them in a taxable brokerage account.

Conclusion

There is no need to choose between Roth IRAs and mutual funds. Investing for the long term can be done with both. In order to understand asset allocation and asset location, you must first understand how they work together.

FAQs

Which is better, an IRA or a mutual fund?

Your IRA is already tax-advantaged, which can minimize your investment tax. On the other hand, passively managed index funds and exchange-traded funds (ETFs) may be more suitable for taxable brokerage accounts. It has already been mentioned that passively managed mutual funds tend to have lower turnover.

Roth IRAs and mutual funds are the same things, right?

A mutual fund holds multiple securities, typically stocks or bonds. Mutual funds, as well as securities, can be held in a Roth. Mutual funds can place funds in Roth IRAs, but Roth IRAs cannot place funds in mutual funds. A Roth IRA represents a container that is unique to you.

Is it possible to have an IRA and a mutual fund at the same time?

In a Roth IRA, you can invest in a variety of investments, including mutual funds, at a tax-advantaged rate.

Roth IRAs or mutual funds are better investments?

Yes, I agree. Roth IRAs can be built on the foundation of stock mutual funds and bond mutual funds.