How to sell a Covered call? are a great investment strategy if you want a little extra cash flow but would still like to hold onto your stocks or options. A call option allows the owner of the option to purchase 100 shares of the underlying stock or one futures contract on or before the expiration date at the price or strike selected by the buyer.

When a covered call is exercised, all rights and obligations come into play, meaning you could assign your counterpart to sell them 100 shares of equity instead of receiving cash.

If the price increases after writing, this can be profitable or risky. Although the writer receives more income upfront, they also have more risk since they have to turn over their position on assignment (unless they use techniques to avoid getting assigned).

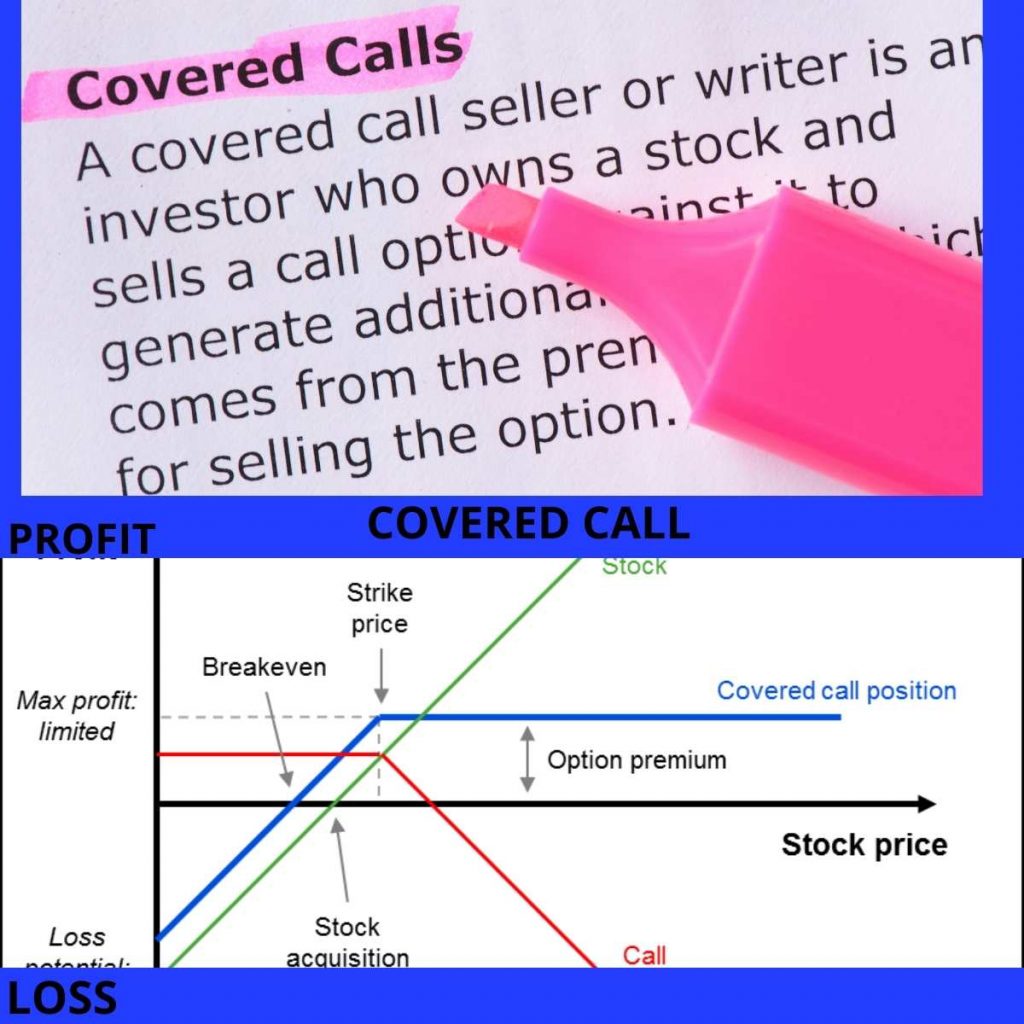

Covered calls definition as per Wikipedia

Covered call strategies involve buying or owning shares of the underlying stock and then selling calls on the stock exchange.

Buy write refers to the simultaneous purchase and sale of stock and calls. Overwriting describes the action of selling calls against previously purchased stock.

Why take a Covered Call?

Investors owning 100 shares of XYZ company purchase a call option. They would rather have $5,000 than their 100 shares, so they purchase a call option.

The extension of their own means that owning 100 shares still has value even if XYZ doesn’t rise above $100. At that point, exercising the option and selling it for $5K would essentially mean selling those original 100 shares for $500 profit.

READ ALSO: Full-time trader

When and How to Sell a Covered Call?

Investors who are not emotionally tied to the underlying stock are most likely to benefit from covered calls. When selling a newly acquired stock, rational decisions are easier to make than when holding it for a long time.

Best Strategy of Selling a Covered Call?

Covered call strategies involve selling call options. To earn additional income from stock, you already own or have recently purchased, you can leverage your existing stock positions.

You are “covered” by the option you sell because you own enough shares to cover the transaction as required by the option.

Covered call strategies can increase income for investors, but they can also limit gains from price increases stock. Become familiar with how covered calls work and whether you should use one.

How Does a Covered Call Strategy Work?

| Options strategies such as covered calls are popular. They can help you generate income from your investment portfolio. Compared to other strategies, they are considered low-risk. |

| Many brokerages allow customers to sell covered calls even if they are not authorized to trade other types of options. |

| Covered calls are considered low-risk because the loss you may experience is limited. It is possible to be exposed to theoretically infinite risk with some other options contracts. |

| Covered calls can be a solid source of income, but you should always be prepared to lose the underlying stock, says Henry Gorecki, CFP. |

| “Be careful if you plan to hold a company for the long term and write calls on it.”The option buyer pays you a premium in exchange for your services. You are not just protecting yourself from losses when you use a covered call strategy. You are also restricting the amount you can earn from a price increase. |

Example of a Covered Call Strategy

- The value of Jane’s investment in the company ABC is $5,000, based on her purchase of 100 shares at $50 each. Her expectation is that the share price will rise,

- As long as the share price remains below $55, Joe is unlikely to exercise the option; it will then expire. Jane is entitled to keep her shares and pocket the $20 Joe paid her. She will make or lose $20, plus or minus any changes in ABC share price from when she bought it for $50 per share.

- In this case, the best-case scenario for Jane is that the stock increases to exactly $55 before Joe exercises his option, but Jane doesn’t.In this case, the best-case scenario for Jane is that the stock increases to exactly $55 before Joe exercises his option, but Jane doesn’t.

- In this case, she gets to keep the $20 she received from Joe and the $5,500 value of the shares. In total, she gained $520 from Joe and the $20 she received from him.

- ABC shares becoming worthless would be the worst-case scenario. In that scenario, Jane would lose the $5,000 she invested.

- The $20 Joe paid her is hers to keep, however. Her total loss would be $4,980. If ABC increases its share price to $60, Joe can exercise his option if the option expires. The shares will cost him $55. Following that, Jane will keep the $20 premium and receive $5,500 from Joe for her 100 shares. Her overall profit will be $5,520. Her shares, which can be sold for $60 each, would have lost her potential profits. Instead of just $5,500, she would have been able to earn $6,000. But because she sold the call to Joe, she has to accept just $55 per share plus the $20 premium.

Pros and Cons of Covered Calls

Pros.

1. Generate additional income from shares you own:

Selling a covered call results in a premium payment from the buyer. When you want to earn income from your portfolio, you can use this strategy to make money every time you sell a call.

2. Setting a target price for your stock can help you:

Covered calls allow

3. Comparatively to other riskier options trading strategies, losses are finite:

Similarly, even if the stock drops to zero and the shares become worthless, the loss is limited as opposed to other options strategies that may expose investors to infinite losses.

Cons

1. If the stock price rises in the future, limit your gains:

Your maximum profit when selling a covered call is the premium you receive, plus Dividends are calculated by dividing the strike price by the current share price. The shares must be sold at the strike price even if the price increases above the strike price.

2. You must continue to own the stock until your options expire:

Occasionally, plans change, and you want to sell some of your investments. As a call remains covered if you own the shares until the option expires, you may be forced to hold the shares longer than you would like.

3. Capital gains taxes apply to net gains:

Depending on a number of factors, you may have to pay short-term or long-term capital gains taxes.

What It Means for Individual Investors

- The strategy of selling covered calls is used by long-term investors looking for extra income from their portfolios.Selecting the right company to sell the option on is the key to success in covered call strategies. Then, select the correct strike price.

- Covered calls work best if the stock price stays below the contract’s strike price. In addition, you can’t lose the premium you receive by selling the option, which provides a slight limit on losses. A primary risk of the strategy is missing out on gains if the value of your investments rises too rapidly.

- When you’re ready to learn about options trading, you might want to start with covered calls. Selling a covered call may be more profitable than owning the stock in some situations. However, options trading is complicated; not everyone is cut out for it. Think carefully before you make a decision.

Conclusion

Covered calls can be used to lower the cost basis or to earn income from shares or futures contracts, adding a profit generator to stock or contract ownership. There are advantages and disadvantages to covered call writing like any other strategy. Covered calls can be a great way to reduce your average cost or generate income when used with the right stock.

FAQs

When should covered calls be sold?

As a starting point, consider 30-45 days in the future, but use your judgment. It is important to find a date that provides an acceptable premium for selling your call option at your chosen strike price. A general rule of thumb is for investors to look for a premium of about 2% of the stock value.

What are the downsides of selling covered calls?

The seller’s profit is determined by the premium received plus the difference between the stock purchase price and the options strike price. Losses on the entire transaction will result if the stock price drops significantly (greater than the premium).

Which is the best way to sell covered calls?

You must first own the (underlying) equity in order to sell a covered call. Moreover, since each call option contract represents 100 shares of the underlying equity, you will need 100 shares x the number of call options you wish to sell.

Is it possible to lose money on a covered call?

Covered call strategies have a maximum loss of the asset’s value minus the option premium received.

Profits from a covered call strategy are limited to the strike price of the short call option, less the underlying stock’s purchase price plus the premium received.

Are Robinhood calls covered?

For selling this contract, you receive an upfront payment (the “premium”). A typical short-call option will obligate the buyer to sell 100 shares of the underlying stock, and the call is “covered” because you already own the shares you might have to sell.