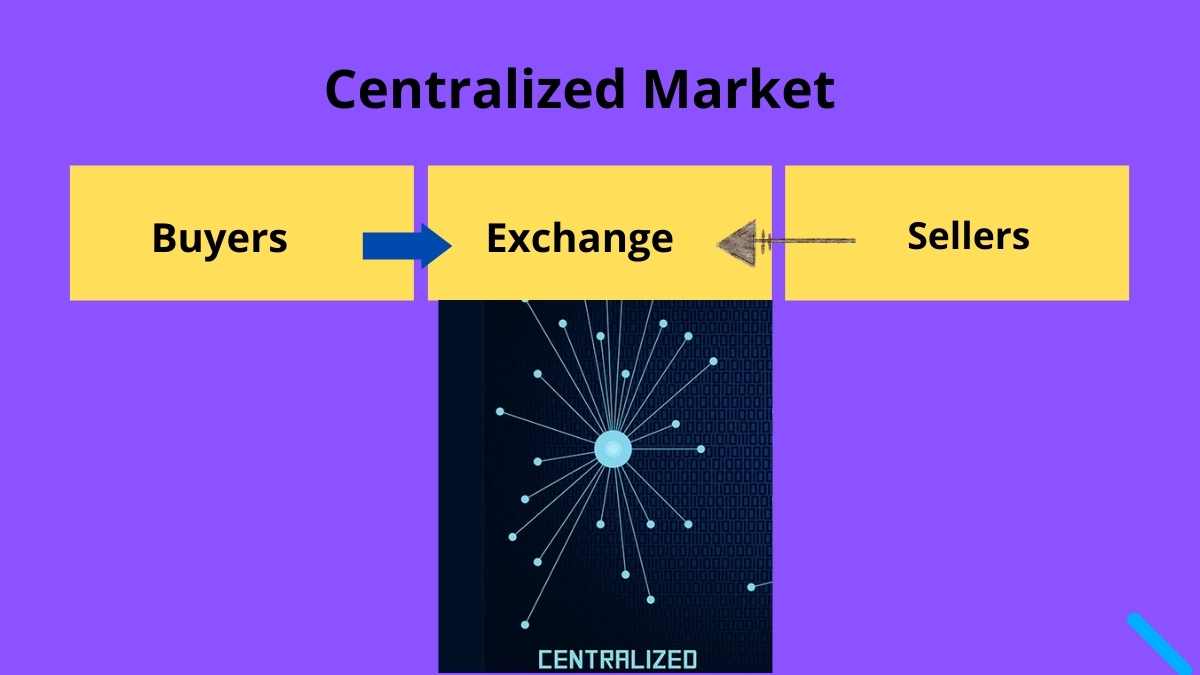

A centralized market (market) is one where there are no competing parties. All orders (purchase and sale) in a centralized market are transferred to a central exchange. There are no competing markets in a centralized market, so all orders are made through one exchange. Those who wish to trade in this type of financial market rely solely on the prices of securities quoted by the market or exchange.

A centralized market has the following characteristics, as you can see from this definition:

| There is only one central market | Orders are directed to one market |

| Currently, there are no competing markets | Securities are priced on the market |

| There is only one price for all investors |

READ ALSO:- Stock Investing Begineers

A centralized market means takeaways.

That’s it for now, folks! How does a centralized market work? (In simple terms, how does it work) ?

Centralized markets are financial markets in which buyers and sellers route their orders through the same system to buy and sell financial instruments and securities. It is a central market because there are no other markets where buyers and sellers can trade the same security.

Central markets have the following characteristics:

| No other competing markets for the same instruments |

| Investors have access to one price quote |

| The clearinghouse ensures that trades between buyers and sellers are executed properly |

Decentralized markets have emerged in recent years, which is the opposite of centralized markets.

A decentralized market allows buyers and sellers to trade with different parties, compete for the best price, and deal directly with one another. Good luck with your investigation and research now that you know what centralized markets are!

The Centralized Market: How Does It Work?

There are many centralized markets around the world, and they all share similar characteristics. There is transparency in the prices quoted; both buyers and sellers have access to the price. Those who wish to participate in the market can also view the quotes and trades available in the market before making their decisions. A popular example of a centralized market is the New York Stock Exchange (NYSE). There is only one central exchange where all buying and selling orders are routed and matched. In the sense that they are different types of financial markets, centralized markets do not have competing markets because transactions done or securities purchased in the market are not readily available in the order markets.

Let’s explore how centralized markets work to understand the concept better.

1. There are no competitors.

A centralized market is one in which all orders for certain financial instruments, securities, or assets are routed through a single exchange (or market). All transactions are conducted on that exchange for all investors.

With a centralized market, securities are purchased and sold in the same exchange without investors having the option of buying or selling the same securities in other competing markets.

2. Pricing that is transparent

- As a result, securities are priced centrally since there is one central market.

- Therefore, all investors will have access to the same price quote at the same time for the same securities.

- It is impossible to invest in the same instrument in a different market at a different rate without a competing exchange or market.

- Because everyone receives the same price quote simultaneously, the pricing of the assets becomes highly transparent for investors.

3. The clearinghouse

- A centralized market has a clearinghouse that acts as an intermediary between buyers and sellers, allowing for the smooth and efficient operation of the system.

- The clearinghouse is responsible for ensuring that the market transactions are properly conducted, effectively ensuring that the buyers receive their securities and the sellers receive their prices.

- As a clearinghouse sits between buyers and sellers, counterparty risk is reduced because buyers and sellers no longer have to worry about who is buying or who is selling securities.

Centralized Market Examples

We’ll look at some examples of central markets around the world to get a sense of what that means. Globally, there are many central markets where buyers and sellers trade various types of financial instruments, securities, commodities, etc.

Here are some examples of central markets around the world:

| New York Stock Exchange | Toronto Stock Exchange |

| Chicago Mercantile Exchange | Athens Stock Exchange |

| London Stock Exchange | Tokyo Commodity Exchange |

| Australian Securities Exchange |

Decentralization and the emergence of markets

Decentralized markets are the opposite of centralized markets. There is competition in this market, which allows investors and traders to choose the best deals because there are multiple exchanges where buying and selling orders are routed. Decentralized markets allow traders to execute their trades without a physical presence so that selling and buying orders can be placed over various markets, locations, and exchanges. Decentralized markets connect buyers and sellers directly. Technology advancements are helping decentralized markets gain more recognition over time.

Contrast a “centralized” market with a “decentralized” market. A decentralized market is one in which buyers and sellers are able to exchange directly without going through a central exchange or market. With the Internet, buyers and sellers can conduct business directly with each other.

For example, peer-to-peer trading programs are examples of decentralized markets in which buyers and sellers deal directly.

Decentralized markets can have the following features:

| Trading the same instrument or asset is possible on many different markets |

| directly between buyers and sellers |

| It is possible to price the same security or asset differently at the same time |

| Many online commerce websites facilitate decentralized trading |

Breaking Down Centralized Markets

In a centralized market, all orders, whether buying or selling, are routed through a central exchange without any other competing market for those particular financial instruments.

The most important characteristic of centralized markets is that pricing is completely transparent and available to all. There is also a clearinghouse in regulated markets that sits between buyers and sellers and ensures fairness in transactions since both buyers and sellers are transacting with the exchange and not with one another.

Conclusion

This blog focuses on starting a business, contracts, investing, and making money for beginners, entrepreneurs, business owners, and anyone looking to learn.

FAQs

What are centralized and decentralized markets?

Prices and transactions are negotiated. On decentralized markets, market makers mediate trades on centralized markets at publicly posted bid-ask prices. Traders search for counterparties.

Is the Forex market centralized?

Foreign exchange markets, also called forex (FX) markets, are not centralized.

A foreign exchange market transaction can take many forms, 24 hours a day, through many channels all over the globe, and whenever one currency is exchanged for another.

Bitcoin is decentralized in what way?

Bitcoin has no central authority since it is decentralized. Bitcoin is a peer-to-peer network without central servers. Bitcoin ledgers are distributed without centralized storage

Is it centralized to buy and sell stocks?

Do stock purchases and sales take place in a centralized manner? If not, why not? Globally, there are many independent stock markets.